The Value of 'Radical' Fintech Innovation

Today's crazy idea is often tomorrow's sensible solution.

A common criticism leveled at fintech is that it’s unsustainable; that behind all the slick user interfaces, modern typography, and hip marketing slogans is a startup burning through investment dollars in search of a profitable business model.

It’s a fair point.

But it’s also a point that is used by banks and other market incumbents to dismiss, en masse, the contributions that fintech companies make to the industry. The internal logic goes something like this:

Peer-to-peer lending is dumb. It’s just like the lending we do, but with a more volatile funding source and a revenue model completely dependent on growth. P2P lenders aren’t a long-term threat to our business. Therefore, nothing that P2P lenders are doing differently than us is worth paying attention to or worrying about.

The reality is (as usual) more nuanced.

While the P2P lending business model hasn’t proven very successful, P2P lenders were some of the first companies to introduce fully digital account opening for unsecured installment loans. And that innovation has proven enormously popular with consumers, as the fintech lenders that came after Prosper and Lending Club can attest.

Banks that missed the boat on building fully digital personal lending platforms five years ago (and that’s pretty much all banks) shouldn’t be blamed for not being first to market with that capability. After all, their businesses were humming along just fine. Customers seemed perfectly happy and building a digital lending platform would have been difficult and expensive.

That said, there’s no excuse for not being second to market.

Absolutely no excuse … except for the very human tendency to dismiss the potential of solutions to tomorrow’s problems, simply because they appear too radical today.

The Overton Window

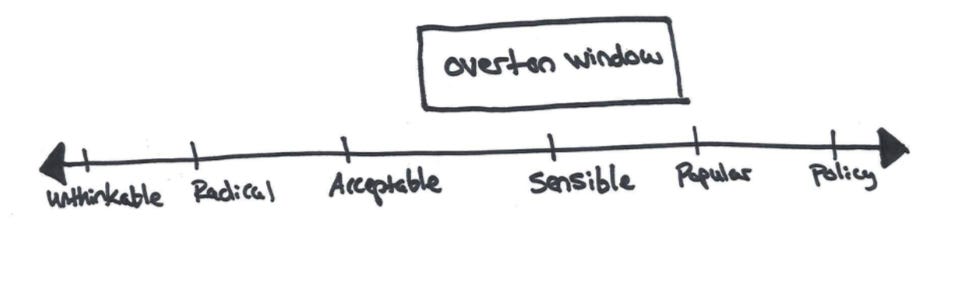

There’s a term for this in political science called the Overton Window.

It describes the range of policies that are acceptable to the majority of the electorate at any one time. The theory is that the viability of any proposed policy depends much more on whether it falls within the window, rather than on the objective rational for the policy or the persuasion skills of the lawmakers advocating for it.

It looks something like this:

Career politicians have a healthy respect for and fear of the Overton Window. Political capital is a finite resource and the Overton Window provides a useful framework for figuring out how to allocate it. Which issues are winners? Which are lead balloons?

The challenge for career politicians is that, while they must husband their political capital carefully, they must also appear bold. Visionary.

So the trick is to identify and advocate early for policies whose windows are already on the move; the ideas that appear bold or revolutionary, but are about to become mainstream in their support among the electorate.

The trick is to be second.

But to do that, someone needs to be first. Someone needs to make the argument for the policy when it’s truly seen as radical. Someone who isn’t constrained by the same forces that push career politicians to timidity. An advocacy group, a think tank, or an outsider candidate with nothing to lose. Think Andrew Yang and his advocacy for a universal basic income.

Fintechs — with their growth-over-profitability mindsets and ample funding — play this role within the financial services industry. Banks that want to appear innovative and forward-looking (again, that’s pretty much all banks) should pay careful attention to the ‘radical’ solutions that today’s fintechs are introducing.

Moving the Window in Small Business Lending

15 years ago, small business owners were caught in an unfortunate gray area; too small to be worth the attention of banks’ corporate lending divisions and too complex to be served by banks’ consumer lending divisions.

There simply wasn’t a good answer, until a group of fintech lenders — led by Kabbage, OnDeck, Square, and PayPal — emerged, offering a fast and fully digital small business lending experience that was (at that time) radically different than anything small business owners had ever seen.

Today, that same digital SME lending experience is highly popular and quickly becoming the default policy for banks of all sizes.

Of course, it’s easy to spot these trends with the benefit of hindsight. The real question is what innovation in small business lending, currently seen as radical, is likely to become mainstream within the next five years?

Here’s Kaz Nejatian (@CanadaKaz), VP and general manager of Shopify Financial Solutions, making the case for something new: microloans for brand new entrepreneurs.

I won’t opine on the merits of this product or its likelihood to succeed (although Seema Amble at Andreessen Horowitz makes a compelling case for it as a low-cost acquisition tool).

I will only point out that, in the current zeitgeist of bank small business lending, this product would absolutely be considered radical.

Additional Reading

You should expect an increase in radical small business lending ideas over the next couple years, thanks to a surge in fintech startups focused on the space. Alex Wilhelm (@Alex) at TechCrunch has a good overview of the increasing interest fintechs are showing to small businesses.

Two of the most interesting examples: Goldman Sachs Marcus potentially making loans to Amazon merchants and Kabbage expanding from lending into payments and invoicing.

Proof that small banks can generate radical ideas — Texas Capital Bank has launched a digital savings account that earns customers American Airlines AAdvantage miles instead of interest.

Ron Shevlin (@rshevlin) with a good overview of the technologies that have made it to the right side of the Overton Window, headlined by (what else?) digital account opening.

Thanks,

Alex Johnson