This is the Bad Place!

Finding and fixing inconspicuous value deficits in financial services.

This quote, ascribed to Jeff Bezos, does a masterful job illustrating the ruthless nature of Amazon’s growth strategy. It’s ominous. It makes you feel like, no matter how far your industry is away from books, you’re not safe.

The quote is also a bit misleading.

Amazon doesn’t attack profit margins. It attacks value deficits.

The distinction is important. Amazon has no problem going into markets with thin profit margins. Groceries is among the least profitable industries out there, but that didn’t stop Mr. Bezos from dropping $13 billion to acquire Whole Foods in 2017.

What Amazon looks for are industries where the value exchange between companies and consumers is out of whack; where the prices that consumers pay aren’t commensurate with the value being delivered to them or the costs associated with delivering it.

eBooks are a good example. In 2014 Amazon was in a tussle with book publishers over the price of eBooks, which didn’t carry the same costs as paper books, a discrepancy that Amazon found intolerable:

high e-book prices are unjustified since publishers have no printing, returns, resales and warehousing to deal with

Often these value deficits appear (or grow wider) due to new technologies — machine learning, cloud computing, smartphones, etc. — dramatically lowering costs and/or enabling new value propositions.

Fixing Financial Services

A thing I like about fintech is that it’s essentially a subsidized, large-scale attack on value deficits in financial services. And even when individual fintech startups fail (which happens all the time), the collective assault on the industry’s conventional wisdom tends to produce positive, long-term effects for consumers.

The first couple waves of fintech, starting with P2P lending in the mid-2000s, focused on big value deficits that were the result of legacy cost structures. Fintech startups, with their lack of branches and manual business processes, were able to successfully attack incumbents in lending, wealth management, and deposits (to name a few). And the results, for today’s consumers, have been great — commission-free stock trading is now standard, overdraft-free checking accounts are plentiful, and small business owners have more credit options than ever before.

The next wave of fintech — which I am personally very excited for — is attacking the smaller, subtler, more pernicious value deficits in financial services. Individually, none of these problems are abhorrent, but in aggregate they are a huge source of frustration for financial services customers.

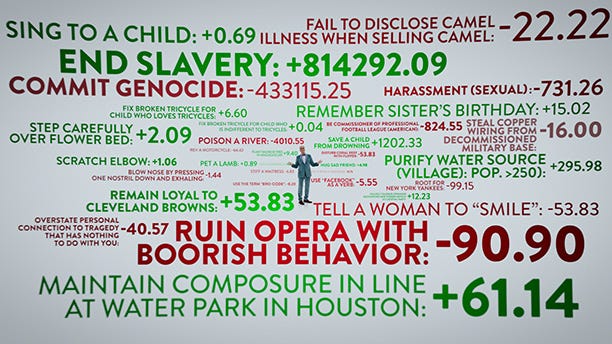

To illustrate what I’m taking about, I’ll borrow a concept from one of my favorite TV shows — The good Place. For those who haven’t seen it, the show revolves around the afterlife, where a person’s final destination is decided by their actions on Earth. Each of those actions is assigned a positive or negative point value and a person’s final score determines whether they end up in the Good Place or the Bad Place.

What I love about the show is that every action is scored. So obviously people like Christopher Columbus, with the slaving trading and genocide, earn huge negative points. But the show also punishes smaller infractions with smaller (but still damaging) negative points; things like rooting for the New York Yankees or using the term “bro-code”.

So, in the spirit of The Good Place, let’s focus on a financial product that hasn’t (yet) been significantly disrupted by fintech and point out some of the bad stuff that need improvement.

Ah Yes, the Mighty Credit Card

First, some context:

Credit cards are popular. 71% of American households had a credit card in 2019, according to the FDIC. Up from 66.5% in 2015.

Credit cards are also enormously profitable.

And, in terms of their core functional purpose — facilitating payments — credit cards work really well, which is why they have hung around for 60+ years and why mobile payments have had as much trouble as it has getting traction.

Despite their success and ubiquity, credit cards have a number of characteristics that would, in a certain TV show, earn them negative points. Let’s review a few of them, subjectively assign our own negative point values, and spotlight some of the fintech companies that are solving for these value deficits.

Making price protection benefits practically impossible to redeem. (-11.26)

Why it’s terrible: Most credit cards used to come with a benefit that allowed customers to get partially reimbursed for a purchase on their credit card if they later found the exact same item that they had purchased being sold at a lower price.

The reason you might not have known about this price protection benefit was that while issuers liked to include it in their marketing materials, they didn’t like to pay for it. So naturally they made the process of submitting a price protection claim stupidly difficult — time limits for submitting claims, copies of receipts and price listings, calling the claims department, etc.

How fintech can fix it: A few years ago, a couple of fintech apps came in and started automating the process:

price-tracking apps have turned a manual, time-consuming, and often aggravating process into an easy, automated activity that saves consumers money. Sounds like a win-win situation, right?

Unfortunately, no. The higher utilization of the price protection feature has likely resulted in more claims and more payouts - thereby increasing the cost of this benefit to card companies … while card companies like to talk about all of the various card benefits available, they may not want you to actually take advantage of them.

Fast forward a few years and Discover, Chase, Citi, USAA, and Mastercard have all cut this “benefit” thanks to the fintech apps calling their bluff.

Giving everyone basically the same rewards. (-17.60)

Why it’s terrible: If you don’t know who Brian Kelly is, that’s probably because you’ve never participated in a credit card rewards strategy meeting at a large bank. You may know him by his sobriquet — The Points Guy.

Mr. Kelly is often on the phone and in meetings with employees from JPMorgan, AmEx, Capital One and Wells Fargo & Co., among others. Some banks consider his advice when they are preparing new cards or changes to existing rewards programs. For example, Mr. Kelly recommended for years that Capital One allow for airline transfer partners, where cardholders can use their points at a number of airlines. In November, after considering additional input from customers and others, Capital One announced the addition of such partners on some cards.

As the quote above illustrates, Brian Kelly is basically the center of gravity for credit card rewards. Everything revolves around a luxury, jet-setting lifestyle that he personifies:

Mr. Kelly’s Instagram account highlights a lifestyle of high-price travel that rewards cards can pay for, boasting photos of him in a hammock in Bora Bora and views of Cape Town from a luxury hotel.

The result is a depressing uniformity in the design of credit card reward programs — point-based systems that emphasize travel and encourage consumption.

How fintech can fix it: The growth of niche challenger banks, focused on specific (often underserved) customer segments promises to be a game changer for those of us who loathe the boring homogeneity of credit card rewards today.

How about rewards tailored to consumers who are trying to climb out of debt or save more money?

The all-new SoFi Credit Card rewards cardholders when they use the cash back earned from purchases to improve their financial big-picture. Cardmembers receive 1% cash back on all eligible purchases and up to 2% unlimited cash back when rewards are redeemed to pay down eligible SoFi student or personal loan debt or save in SoFi savings or investment accounts.

How about rewards designed for the insanely passionate Cleveland Cavaliers fans among us?

Instead of flights and resort stays, perks could include basketballs autographed by the team or the chance to be an “honorary benchwarmer” as players warm up before a game

Or rewards that mirror the way that gamers play video games?

rewards are available on Steam, Xbox, and Playstation. Each swipe gives a random reward box. What's in that box could be a $2000 laptop or just their currency (Gems). Gems are like airline miles, but "much easier to redeem." They also have challenges like "buy something from amazon" to get extra Gems. Mythra is gamification for gamers by gamers.

Forcing consumers to remember to rotate their rewards. (-26.85)

Why it’s terrible: Here’s the answer to a question in Chase’s Q&A for its new Freedom Flex card on why cardholders need to activate the card’s 5% cash back reward every quarter:

We ask you to activate because we want to make sure you’re aware when categories change and where you can earn 5% cash back.

Translation: we change the rules on your rewards every three months and we’re counting on the breakage from a certain percentage of cardholders who will forget to activate their rewards but will keep spending like they’re earning 5%.

Don’t worry though. Cardholders can activate their 5% cash back through the branch, call center, ATM, online, or email!

How fintech can fix it: Software exists to do work for us (as Gil Akos so eloquently put it). So let’s employ some intelligence and automation and remove a little cognitive load from our customers.

Here’s Venmo:

The card provides a unique, intelligent rewards system capable of managing and personalizing your spending habits. You’ll earn up to 3% cash back* on your top spend category, up to 2% back on the second highest, and 1% back on all other purchases you make. What sets the Venmo Credit Card apart is that it maximizes the cash back you earn, automatically adjusting your top spend categories each statement period based on where you spend the most.

And HMBradley:

The card features 3% cash back in your top spending category, 2% back in your second biggest spending category, and 1% everywhere else … There's no limit to how much cash back you can earn … If you use this card for at least $100 in monthly purchases, you'll qualify to move one tier upward for your savings account interest rate. That could be worth an extra 0.5% to 1% in interest on your savings account.

Encouraging customers to revolve rather than pay off debt. (-340.72)

Why it’s terrible: There are mountains of research on this one. Some lowlights:

In 2019, consumers paid approximately $122 billion in credit card interest.

According to the Federal Reserve, Americans owed nearly $1 trillion in credit card debt at the beginning of 2020.

Nearly 2 in 5 consumers who have had credit card debt said it affected their general happiness, NerdWallet found. One-third said it negatively affected their standard of living, and 1 in 5 said it negatively impacted their health.

How fintech can fix it: Given the profitability of revolving balances for credit card providers, it’s not surprising that we’re still in the early innings on this one. Here are a couple of ways that fintech can potentially help:

Buy Now Pay Later. The stated purpose of BNPL providers like Klarna and Affirm is to provide a more flexible and transparent alternative to credit cards. In a strict sense, there’s some truth here. The nature of installment lending at the point of sale generally makes it easier for consumers to understand the total cost of borrowing for specific transactions. In a broader sense, it seems prudent to worry that the ease of BNPL may be luring consumers into purchases they can’t afford. Here’s a recent quote from Klarna CEO Sebastian Siemiatkowski:

“If we don’t charge [fees] in the UK, are we doing a good thing? Or are we encouraging people?… We’re trying to find a balance.”

Credit builder cards. A new generation of secured credit cards are being designed by fintech companies with the intention of helping customers use the card safely and establish/improve their credit scores. cred.ai is one such company:

cred.ai automation and the cred.ai guaranty makes sure you never pay fees or interest and never overspend, and automatically manages your balances to optimize your credit utilization.

A better user interface. Perhaps the easiest solution, and one where fintech companies can set an example for banks to follow, is introducing more customer-friendly user interfaces for managing their credit cards.

Card is the best example of this that I’ve seen:

Don’t Settle

It’s easy to get used to the way things are. Fintech, at its best, doesn’t allow banks or their customers to do that.

Short Takes

(Sourced from This Week in Fintech)

Customer Acquisition Hack

Step, a digital bank for teens, raised $50 million from investors including The Chainsmokers, Justin Timberlake, Charli D’Amelio, Eli Manning, and Will Smith.

Short take: It honestly may be more cost effective at this point to recruit celebrities as investors and have them (as part owners) promote their company than it would be to pay them to promote your company (as influencers). Such is the state of digital customer acquisition in fintech.

Everything is Fintech

Stripe is partnering with Goldman Sachs and Citibank to enable turnkey banking-as-a-service products to platforms, beginning with Shopify and its Stripe Treasury product. Stripe also launched capital-as-a-service this week, so that its business customers can lend to their clients.

Short take: I’ll have many more thoughts on this in an upcoming newsletter. For now, I thought this detail shared by Kaz Nejatian at Shopify on why Stripe was their partner of choice was really insightful:

Seriously, EVERYTHING is Fintech

Cash App now has an apparel collection.

Short take: I jokingly said that this was the piece of fintech news last week that finally broke my brain (and it kinda did), but I do find it legitimately interesting. Banks hem and haw over investments in mobile apps vs. branches. Square invests in culture. That, maybe more than anything, illustrates the simple truth that banks and fintech companies are playing vastly different games.

Thanks,

Alex Johnson