Why Self-Driving Money is So Hard

Hint: it's not a technology problem.

The great thing about engineers is that they don’t tolerate ambiguity. If people start getting excited and tossing around terms like ‘self-driving cars’ and ‘autonomous vehicles’, they’ll wade right into the middle of the fray with frameworks and technical definitions and try to bring a little order to the madness.

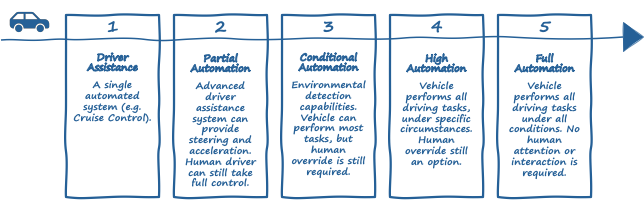

Enter the Society of Automotive Engineers, who introduced a framework for defining the Five Levels of Driving Automation (technically it’s six levels, but Level 0 is no automation, which is boring).

The levels progress smoothly from simple driver assistance features like cruise control to more sophisticated capabilities like steering assistance and automated lane changing and, finally, to Level 5 — full automation.

What I find interesting is that while this framework provides a wonderful mechanism for defining and categorizing various forms of autonomous transportation (which is what it was designed for), it’s not great at clearly articulating where the customer value is.

Because the reality is that, from the customers’ perspective, driving a Level 1 car is a lot like driving a Level 4 car.

Sure, a Level 4 car is easier to drive. Much easier. But you’re still driving. You still have to pay attention and be ready to take control. All of the benefits that we were breathlessly promised in 2015, when self-driving car hype was at its apogee — sleeping during your commute, playing board games with the whole family on a road trip, sending your car out by itself during the day to make a little money as an automated taxi — these only happen at Level 5.

So, from a value perspective, the levels of driving automation look more like this:

Self-Driving Money

The end state of the bank of the future is a digital assistant that is constantly thinking about your best financial interests … Almost like having your own CFO whose job it is to optimize your money, uncover ways for you to improve your financial situation, and is relentless in that pursuit.

And:

It allows you to maximize what you're earning, because everything can happen as quickly as technology can support it, instead of as quickly as you can get around to thinking about moving money around … With self-driving money, you're in control, but money gets put in the right place at the right time to help you maximize it.

The first quote is from Adam Dell, a Goldman Sachs partner and head of product at Marcus. The second quote is from Chris Hutchins, head of autonomous financial advice at Wealthfront.

Both quotes describe a concept that is commonly called ‘self-driving money’ (a term coined by Wealthfront). Here’s the vision (by way of analogy) from Angela Strange at Andreessen Horowitz:

When you enter your desired destination into Google Maps, the app plots out the fastest, most efficient route, even adjusting for traffic and coffee stops along the way. You don’t even need to enter your current location—Google Maps already knows where you are. What if that same predictive software existed for our finances? Imagine a future where you could outline your goals as a student—say, graduate, move to your dream city, save for a house, plan for kids—and an app would execute your optimal financial plan, rerouting and adjusting for “traffic” along the way.

Sounds pretty good, but so does fully autonomous driving. How close are we actually to having a ‘Google Maps for money’?

Channeling my inner engineer for a second (and ignoring the lending and payments facets of self-driving money), here’s what I think a ‘5 Levels of Money Automation’ for deposits and investments looks like:

Level 1 is what we all already have — the ability to schedule automated transfers from one deposit account to another. Every checking account comes with this today (much as every car today comes with cruise control).

Levels 2 and 3 are where things start to get interesting. At this stage of the framework, consumers can have the self-driving money service monitor an account of their choice (using data aggregation) and take action to move money out of that account and into an account offered by the service provider. The key difference between Level 2 and Level 3 is who decides when to move the money.

Level 2 services (like the new Autopilot feature from Wealthfront), utilize specific rules set by the customer — “when my checking account has more than $15,000 in it, transfer the remainder to my investment account.” Level 3 services (like Digit or the Surprise Savings feature from Ally) utilize machine learning algorithms to understand the deposit and spending patterns of each customer and take action automatically (with no direction from the customer) to sweep money aside for saving.

Level 3 services provide a more convenient experience for customers than Level 2 services (particularly when you consider that services like Digit provide liability against any accidental overdrafts caused by their algorithm). However, the big jump in customer value — like the jump from high automation cars to full automation cars — comes when we move from closed self-driving money services to open ones.

Remember, while providers like Wealthfront, Digit, and Ally allow customers to take money out of any deposit account, they only allow you to move money into an account that they provide. The financial benefit of this to Wealthfront, Digit, and Ally is obvious, as is the cost to customers in terms of limiting the vision of self-driving money. As Nik Milanovic correctly notes:

Self-driving money limited to one app is like a self-driving car that only works on one road.

To fully realize the vision (and value) of self-driving money, customers need the freedom for their money to move from anywhere to anywhere, automatically.

Level 4 services like Astra enable customers to link all of their financial accounts (deposit and spending) together and then create ‘routines’ that facilitate automated transfers under specific conditions — scheduled transfers, round ups on payment transactions, percentage-based transfers on new deposits, etc.

Level 5 services — the open banking equivalent to Digit — aren’t yet prevalent in the market (to my knowledge). Not surprising when you consider the added complexity of designing an algorithm that customers can trust to automatically balance transfers across a range of constantly changing external accounts (to say nothing of the data quality challenges inherent to all aggregators).

The Future of Self-Driving Money

So, when are we getting fully autonomous, algorithmically-driven, open banking-powered self-driving money?

I fear that we’re in for a bit of a wait, for two reasons:

While services like Digit and Astra are breaking ground on the technical and UX advances necessary to deliver Level 5 automated money (editor’s note: I’m a customer of both services and find them delightful), they are still small and comparatively unknown to the typical financial services customer (follow-up editor’s note: I am not a typical financial services customer; I’m a huge fintech nerd). Building a consumer-facing fintech brand and acquiring profitable customers without burning through all of your capital is really hard.

Larger, better-known financial services brands — traditional banks, established challenger banks, robo-advisors — have a compelling reason to stop before Level 4.

Take Goldman Sachs Marcus as an example. It may legitimately believe, as quoted above, that the end state of the bank of the future is a personal, digital CFO for every customer. But given the fact that every $10 billion in Marcus deposits reduces Goldman Sachs’ cost of capital by $80 million, will it really empower that CFO to move money out of Goldman Sachs’ walls, even if it’s best for the customer?

You can build a framework for self-driving money. You can translate that framework into a product roadmap. The hard part is delivering on that roadmap when it means cannibalizing your existing business.

Thanks,

Alex Johnson