Foolish Fintech Questions

And a quick professional update!

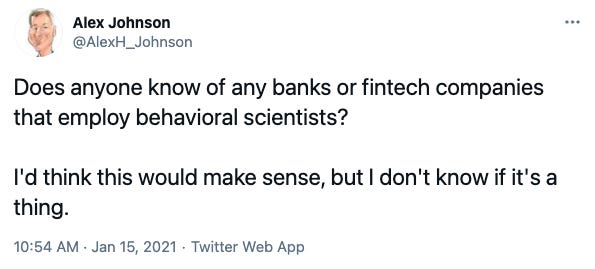

Perhaps my favorite part of writing this newsletter and participating in the incredible community that has sprung up around the fintech industry over the last 15 years is the ability to ask foolish questions like this:

And get a ton of thoughtful responses and introductions to patient, highly knowledgable experts who are willing to let me pick their brains.

Beyond the SPACs and unicorns and memes, the foundational value that fintech provides is a place for smart, creative people to come together and talk about how we can make financial services work better for everyone.

A place that tolerates (even encourages) the occasional foolish question.

In that spirit, there are two things I’d like to share:

First, a quick professional update — I have joined Cornerstone Advisors as Director of Research and Consulting, focused on the fintech space 🙌

In this role, I will get even more opportunities to indulge my endless curiosity while working with some incredible companies to conduct consumer surveys, market studies, and much much more. If you’re interested in partnering with Cornerstone to get the answer to a burning question, reply to this email. I’d love to chat!

With the goal of continuing to learn in public, I want to periodically share my running list of foolish fintech questions in this newsletter, in the hopes that it will inspire some good discussion, debate, and (perhaps) solutions over time. To help with this exercise, I’ve also recruited a few of my favorite fintech folks to contribute their own ‘foolish’ questions.

The questions below (and my accompanying commentary) span the gamut from tactical questions about recent industry news to questions we wish we’d been bold enough to ask earlier in our careers to more profound questions that don’t have easy answers. If you have thoughts on these questions or new questions to add to the list or resources that might help answer some of these questions, please reply to this email!

Foolish Questions

How do fintech startups make money? —Jason Henrichs

Is giving up payment for order flow (which isn’t as pernicious as it’s made out to be) in exchange for tips (which likely won’t come close to replacing the revenue) going to be worth it for Public? —Alex Johnson

Robinhood and Public are competing to get to a scale where payment for order flow becomes a small contributor to their bottom line. Will this help Public get there faster?

How many customers would prefer the upside of a more volatile rewards scheme (BlockFI, Fold)? And how would that preference change between a low rate environment and a high rate environment? —Alex Johnson

Personally, I’d never go for it. How big is this potential market?

What’s DeFi? —Packy McCormick

I could use a primer on this as well!

What do Visa and Mastercard actually do? —Jason Henrichs

Why is interchange so esoteric / variable? —Jason Henrichs

Great question. We talk about (and regulate) interchange like it’s one clearly defined number. It’s not.

Is Plaid going to play nicer with banks post-Visa? —Alex Johnson

This is the story being told in the market. Will this actually happen? Will it apply equally to banks of all sizes?

What is a payment? —Simon Taylor

What are payments rails? —Packy McCormick

How do partner banks that rent out their charters differentiate themselves as more competitors move into the space? —Alex Johnson

Dan’s tweet got me thinking about this.

Which fintech companies are creating consumer hype in middle America like Cash App, Robinhood, and Affirm have on the coasts? —Nikil Raju Konduru

Great question. I’ve learned about a lot of interesting, between-the-coasts fintech companies by attending V-Sum. Interested in learning about more consumer-focused ones!

What does the full tech stack look like for the 30 million small businesses in the U.S.? —Chris Wallace

And how will small business owners’ use of technology change post-COVID?

What is the card issuing process and who does what in that process (think stakeholders like: Issuer, Sponsor Bank, Processor, Production Partner, Packaging Partner, etc)? —Nina Mohanty

Wouldn’t it make more sense for Peloton to offer a credit card rather than a BNPL loan? —Alex Johnson

Seems like they would benefit from the ongoing rewards program given the subscription-oriented nature of their model and their desire to sell expensive accessories.

What’s a STIP? —Nina Mohanty

I honestly don’t know. Someone help!

Why do we need regulation? What are the alternatives? —Simon Taylor

Color me intrigued 🤔

Lending lifecycle - what actually is servicing, collections, onboarding, etc.? —John Piazza

Why is fraud such a big problem and why isn’t it talked about more? —Jason Henrichs

Feels like a part of the reason is that it’s hard to define and detect (particularly for first-party fraud)…

What are the categories where technology is really transforming a financial service? Where does the tech part of fintech really dominate? Are they just using more software to do what they do or is software really changing what is being done and how? —Sar Haribhakti

I’d love to see someone outside our fintech bubble try to answer this question. Feels like we’re all too close to it.

Why is AML / KYC such a big deal? —Jason Henrichs

Simon Taylor wrote about this one a bit here.

Why is the fintech vendor landscape so confusing? —Simon Taylor

Do we really need so many micro-plays in fintech (lending for this, debit card of that)? —Jason Henrichs

I’m excited about the potential here, but it’s a very fair question.

What really is fintech? We keep hearing “everything is fintech” but is it? How do we decide what isn’t fintech? What are the bounds? Does it matter? —Sar Haribhakti

Does fintech really make an impact on poverty? —Nik Milanović

This is the trillion-dollar question.

Alex Johnson is a Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies.

Twitter: @AlexH_Johnson

LinkedIn: Linkedin.com/in/alexhjohnson/