Hands-on-the-Wheel Money

The future of banking might not be what I thought.

What is the future of banking?

This question is something of an occupational hazard in my line of work; one of those things that comes up from time to time and that you will be happier if you have a good answer prepared for it.

I had a good answer.

It went something like this:

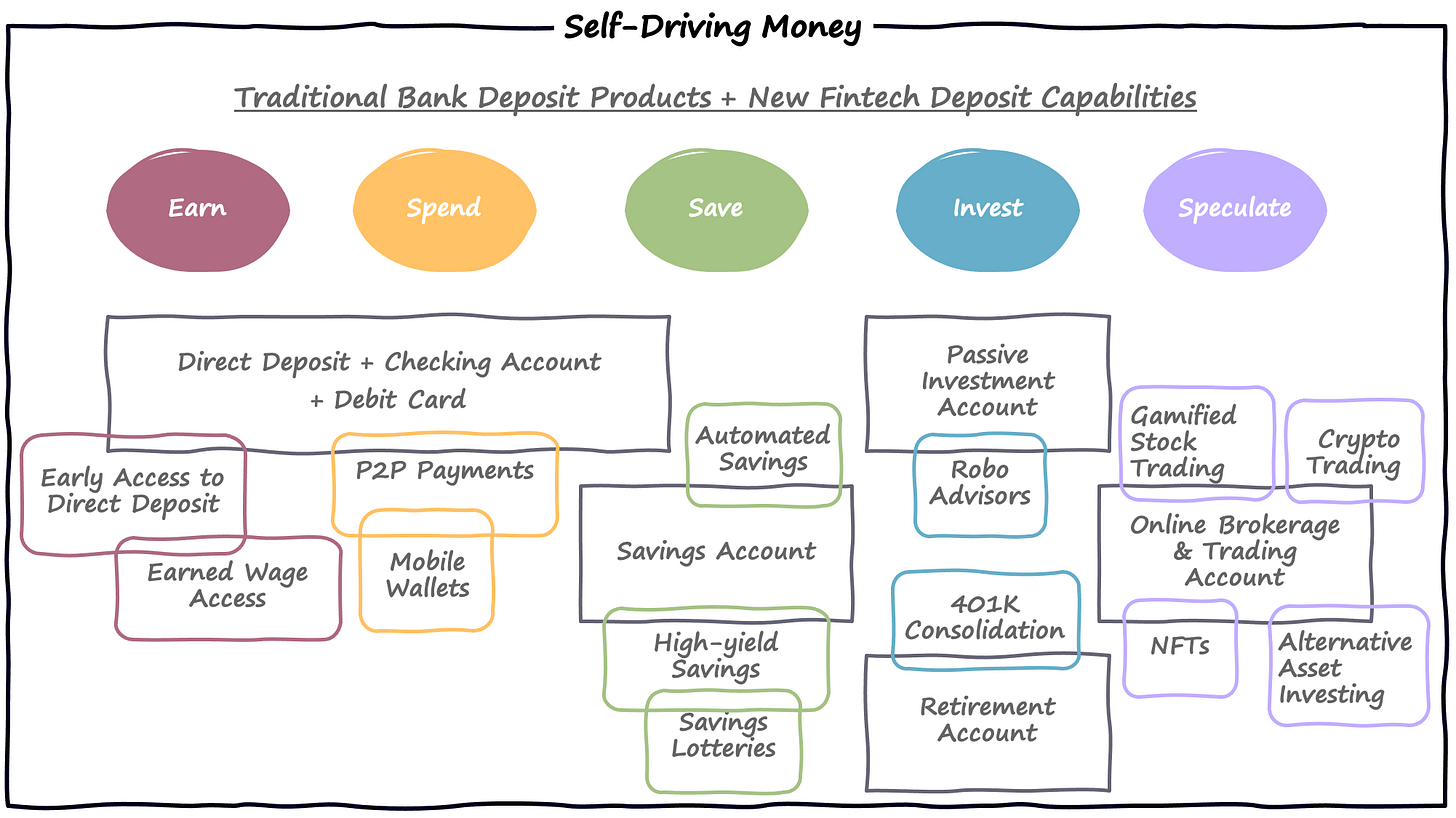

There are a few essential jobs to be done within the realm of deposits.1

Earn — provide a place for consumers to deposit their income and facilitate faster access to that income and create opportunities to generate additional income.

Spend — facilitate payments; everything from paying bills to shopping to repaying a friend for lunch.

Save — increase the percentage of money set aside for future needs and long-term opportunities.

Invest — generate desired return, at acceptable risk levels, over a long time horizon.

Speculate — generate maximum return over a short time horizon, with the expectation of significant risk and volatility.

Over time, banks built a series of products to help consumers with each of these jobs to be done.

These products became stagnant as the incumbent banks shifted their focus away from innovation. As always happens, people noticed and fintech companies started popping up and augmenting these legacy product categories with innovative new capabilities.

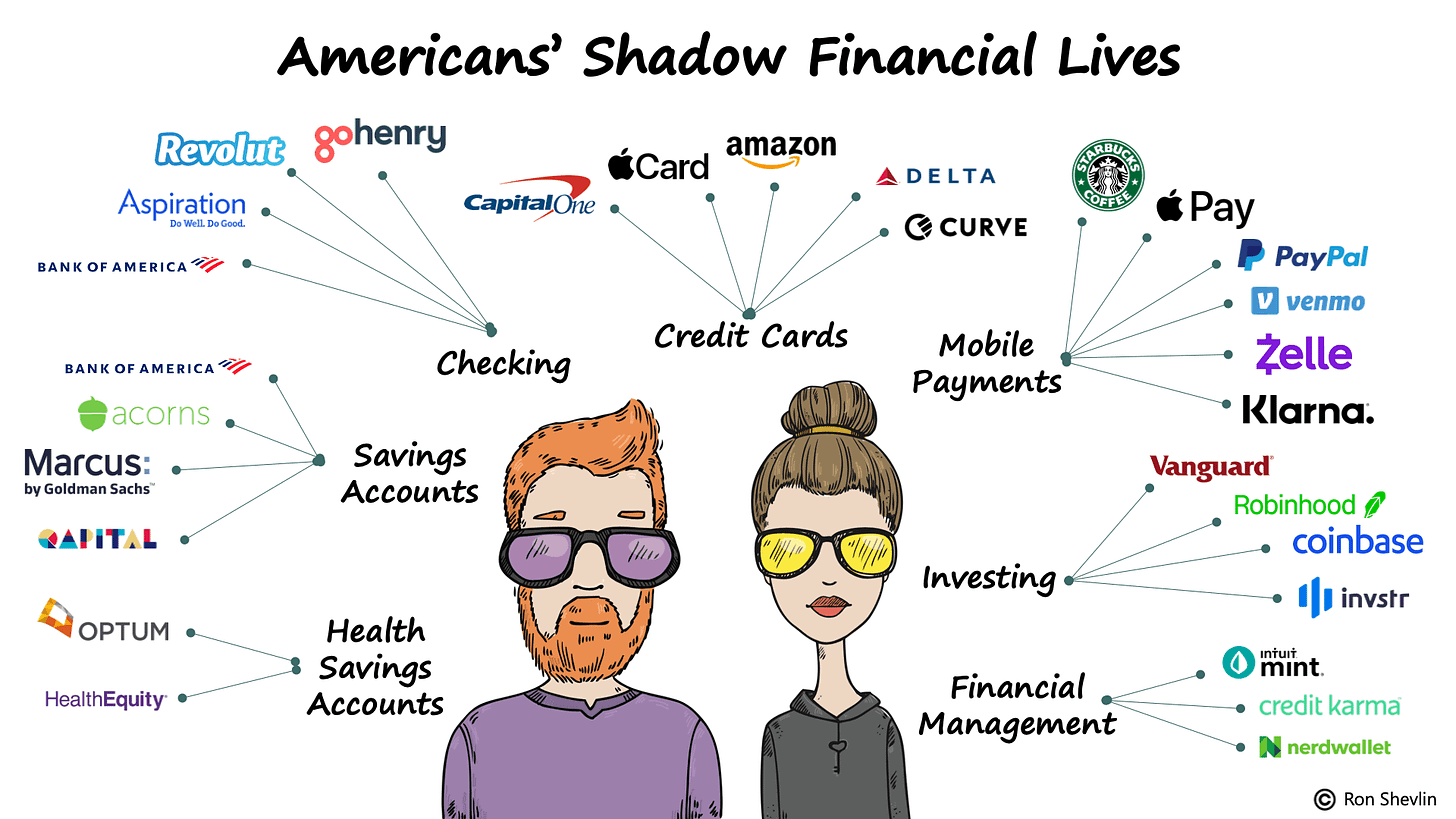

This was both a good and bad thing. The good news was that consumers had way more choices for addressing these five fundamental jobs to be done. The bad news was that their financial lives became much more complex to manage as the number of different bank and fintech services they were using increased. According to research from Cornerstone Advisors, nearly half of Millennials have more than one checking account. And this is just the tip of the iceberg, as my Cornerstone colleague Ron Shevlin helpfully illustrated:

To solve for this, we would wrap consumers’ increasingly complex and fractured financial lives would be with an intelligent, highly automated service that would allow them to reap all the benefits of our diverse, highly competitive financial services ecosystem without requiring an excessive amount of work to manage it all. We would give them Self-driving money.

Now sure, I had concerns about self-driving money. The vision painted by founders and VCs always seemed a bit ambitious, from both a technical and business model perspective.

That said, I very much bought into the concept and assumed that we would eventually get there. This quote from Adam Dell, a partner at Goldman Sachs and head of product at Marcus (at the time), summed up my thoughts well:

The end state of the bank of the future is a digital assistant that is constantly thinking about your best financial interests … Almost like having your own CFO whose job it is to optimize your money, uncover ways for you to improve your financial situation, and is relentless in that pursuit.

The future of banking is self-driving money … or so I thought.

A New Theory on the Future of Banking

We should start with an example.

Scenario: Let’s pretend, just for fun, that AMC (the movie theater company) decides to buy a stake in a gold and silver mine in Nevada.

What happens next?

In the old world: Given that AMC isn’t a top-tier public market stock, this news generates few if any headlines. The few stock market analysts that cover AMC view it as a bizarre if somewhat low-risk hedge and don’t materially change their views on the value of the company. Retail investors using online brokerages like E-Trade mostly ignore the stock. The average banking customer is completely unaffected.

In the new world: The news is covered widely because, well, it’s a good joke. Stock market analysts still don’t really get it, but the stock goes up because retail traders who are checking their trading apps multiple times per day appreciate Adam Aron’s mastery of memes. One of those retail traders sends her friend $5 worth of AMC stock using a P2P payments app because, obviously, it’s going to the moon. This encourages that friend to buy an additional $75 worth of AMC stock in his digital banking app, which he chooses to liquidate 6 hours later in order to use the modest capital gains to pay for dinner and a movie (at an AMC theater, of course).

Two things to point out here.

First, the new world scenario I just described isn’t theoretical. It’s what actually happened. AMC really did buy a gold and silver mine and that did cause its stock to go up.2 And while I can’t say exactly what individual consumers did in regards to AMC’s stock, I can say that sending $5 worth of it to a friend and buying more of the stock and then liquidating it at the point of sale to make a purchase are all things that consumers are empowered to do today, thanks to the latest generation of fintech products.

The second thing to point out is that all of this is really weird! It is emphatically not the ‘digital assistant constantly thinking about your best financial interests in the background’ future that Adam Dell prophesied. It’s basically the opposite. And I think it’s worth figuring out what big picture things have changed in financial services (and society, more broadly) to bring us to this place. I think there are three:

1.) Fintech infrastructure makes it easy to blend product categories together.

The reason that checking accounts, savings accounts, retirement accounts, and brokerage accounts have, historically, existed as separate, siloed products within banks is because they each independently evolved to address their distinct jobs to be done within deposits.

This was never a problem because the separation of these products served another unintended, but useful purpose — it introduced a helpful amount of friction when attempting to move money between them. In the same way that sometimes being a good stock broker means not answering your clients’ calls during a market crash3, the friction that has existed when moving money between savings and checking or between checking and an online brokerage account can serve as a type of useful governor on consumers’ more impulsive financial decisions. It essentially tells customers to just leave well enough alone, which in a world with compounding interest and a stock market that basically always goes up (over a long enough time horizon), is often financially beneficial.

However, thanks to the abundance of fintech infrastructure available to product developers today, these historical constraints no longer apply. If you want to build a P2P app that lets customers buy/receive/send/pay with fractional stocks and cryptocurrencies, you can do that with calls to half a dozen APIs. No big deal.

Now, of course, just because fintech product developers can blend these different product categories together and erase the friction that has traditionally existed when transacting between them doesn’t mean that they will … except that …

2.) Money is fun.

A key to the success of any consumer-facing fintech company is engagement — continually finding ways to increase the amount of time that customers spend in your app. The more engaged a customer is, the more opportunities you have to cross-sell additional revenue-generating services, which leads to lower customer acquisition costs and improved retention.

You know what’s engaging? Money. You know why? Because it’s really fun, as I wrote a while back:

Here’s a simple truth, which we often dress up in fancy words or avoid discussing altogether — money is fun. It’s fun to earn. It’s fun to spend. It’s fun to save and watch compound. It’s fun to wager.

And because money is fun, financial services providers have always had an inherent advantage over companies in other industries in getting their customers to engage frequently and deeply with their products and services.

And you know what’s not fun? Waiting days (plural!) to transfer money from your checking account to your brokerage account so that you can ape into the latest coin that Elon Musk winked at on Twitter or show Adam Aron that you appreciate his sense of humor.

So, if you are a fintech product developer and your job is to increase user engagement, why wouldn’t you take advantage of all this new fintech infrastructure and figure out some novel ways to seamlessly weave speculation (which is, by far, the funnest category of banking capabilities) into your bank product? Make it quick and easy to have fun! Your customers, particularly your younger customers, will thank you.

Speaking of which …

3.) Gen Z feels forced to be “risk on”.

You know who disagrees with my earlier assertion that a little friction can be a good thing for consumers because, long term, inaction is often more financially beneficial than excessive action?

Gen Z.

Gen Z vehemently disagrees:

I’m not generally a fan of generational bellyaching (find me a generation who doesn’t believe that the prior generations screwed them over) and I know one person on Twitter isn’t a statistically significant sample size, but I do think these tweets effectively convey an emotional trend that is important — many Gen Z consumers seem to feel hopeless about their ability to achieve financial security and build wealth.

It’s not really important if these feelings are rational. It’s how they feel. And that matters because it explains why a Gen Z consumer might view getting their paycheck automatically converted to crypto or paying for lunch using the capital gains from a meme stock sale as financially smart choices.

Put simply, from this perspective, volatility is a feature not a bug.4

Hands-on-the-Wheel Money

The reason that self-driving cars are a tempting point of comparison when trying to envision the future of banking is because, historically, banking felt, to the average consumer, a lot like making that twice-daily commute to work — slow and monotonous and yet, somehow, also mentally exhausting.

Who wouldn’t want to automate that? Who wouldn’t want to reclaim that wasted time and spend it on something more valuable?

But what if banking didn’t feel like that at all? What if it felt like a high-risk, high-reward, death-defying chase through a barren and hostile wasteland where everyone and everything was trying to kill you?

If it felt like that, self-driving money is the last thing you’d want. You’d want control. You’d insist on it. You wouldn’t trust your safety to some algorithm. And even if you did trust it, you still wouldn’t use it because it would be embarrassing. Your peers would mock you. You would want to keep your hands on the steering wheel at all times.

This increasingly seems to be the mindset of younger financial services consumers, which manifests as a type of recklessly brave, adrenaline-seeking financial decision making in the face of (perceived) overwhelming odds. WAGMI is the new “witness me!”

And fintech companies are starting to shape their products to align with this emerging zeitgeist. These products make up a new category — the antithesis of self-driving money — hands-on-the-wheel money.

It’s important to remember that hands-on-the-wheel banking is very new. It couldn’t exist even a few years ago because we didn’t have fintech infrastructure companies providing easily consumable APIs for each of the five jobs to be done in deposits. Today, we do, including (crucially) for speculation, thanks to embeddable fractional stock trading and crypto services from companies like Alpaca and Zero Hash.

And what are fintech product developers building in this new sandbox? Let’s take a quick tour:

Cash App recently introduced the ability for users to directly send each other fractional amounts of stock or bitcoin. This is a first, within the world of P2P payments, and the implications are fascinating. In the same way that Venmo allowed consumers to personalize payments with memos, Cash App is now allowing users to personalize payments through the choice of asset. My friend just repaid me for drinks last night by sending me $40 worth of $ML. What are they trying to say! 5

Fold offers a debit card with an interesting rewards program. Rather than earning points or miles according to a fixed structure or even based on rotating merchant categories, Fold debit card users that make qualified purchases earn opportunities to spin the virtual prize wheel within the Fold app. This gives Fold customers the chance to win prizes, which can range from 100 Sats (roughly 4 cents) to 1 bitcoin (your odds for this are 1 in 10,000). Customers are required to spin the wheel within a short window of time after the qualifying transaction is completed, although that window can be extended (and extra spins can be earned) by paying a $150 annual fee for the Spin+ Debit Card.6

OnJuno is one of an emerging class of ‘crypto neobanks’ that offers a combination of tradfi features (high-yield checking, debit card) and defi features (buy and sell multiple cryptocurrencies). Its most notable feature is the ability for consumers to elect to automatically convert a portion of their paycheck (if they enable direct deposit) in crypto. The crypto can be allocated into a single cryptocurrency or split across multiple (BTC, ETH, USDC). The primary utility of this feature is, according to OnJuno’s website, to “enable the crypto community to live natively in crypto”. However, the primary appeal of this feature (judging from the company’s marketing) is more around striking it rich like Olaf Carlson-Wee.

Wedge is a hybrid investment and spending app. It allows customers to trade stocks, bonds, ETFs, and Crypto and to ‘spend’ any of those assets in real time at the point of sale. The app empowers customers to choose the specific asset they want to use or, alternatively, it can automatically select the best asset for them. The pitch for Wedge revolves around control — we will give you the tools to harness market volatility and save money on each purchase.7

Is Self-driving Money Dead?

I’ll admit that the sale of Wealthfront — one the big proponents of self-driving money — to UBS and the exit of Adam Dell (and many other senior executives) from Goldman Sachs Marcus has shaken my faith a bit.

Self-driving money (like self-driving cars) appears to still be more of a theory than an in-market reality.

That said, I’m also not convinced that hands-on-the-wheel money will replace it. The last few years have given us a number of macro trends — pandemic-fueled boredom driving interest in financial speculation, low interest rates, rising inflation, strong but volatile performance for stocks and crypto — that have made hands-on-the-wheel money solutions look especially appealing.

Those trends likely won’t hold. At least not all of them. The market, like this newsletter, tends to be cyclical.

Short Takes

1.) Another fintech acquisition for Apple.

Credit Kudos, a UK open banking startup that helps lenders make better decisions, has been acquired by US tech giant Apple.

Short take: Credit Kudos specializes in loan underwriting using cashflow data, so the guess here is that their technology will be used by Apple to reshape Apple Card and/or launch new BNPL functionality. In both cases, the ability to evaluate consumers for credit without those consumers needing to have prime credit scores is very valuable.

2.) Embedded finance is eating commercial banking.

Baselane, a company that helps independent landlords manage bookkeeping and collect rent, announced that it added a banking platform to the mix.

Short take: Question — how do you eat a massive small business and commercial banking market controlled by thousands of banks? Answer — one bite at a time.

3.) Bet on the team.

Corporate management startup Ramp has secured $550 million in debt and $200 million in equity in a new financing that doubles its valuation to $8.1 billion.

Short take: One thing I’ve observed is that the funding rounds that appear the most crazy (and this one fits the bill) are usually the result of the intense belief that a specific investor has developed over time in a specific founding team. That seems to be the story with Ramp and Founders Fund’s Keith Rabois, who is quadrupling down on his original bet.

🎵 On the Road Again 🎵

April and May are going to be BUSY. I may set a new personal record for most conferences in the shortest span of time. If you are going to be at the same events, I’d love to meet IRL!

First up — New York Fintech Week.

Empire Startups is graciously allowing Jason Mikula (of Fintech Business Weekly) and I to share our thoughts on the future of consumer lending.8 You should join us! Register here.

Alex Johnson is a Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies.

Twitter: @AlexH_Johnson

LinkedIn: Linkedin.com/in/alexhjohnson/

I have a different, but still very good answer for “what is the future of lending?”

Nearly 7% after the deal was announced.

I’ll let Matt Levine elaborate:

“It is well known that one of the best services a retail broker can provide is not answering the phones during a crash. The market is down, the customers panic, their timing is terrible, they want to sell at the bottom, they call you up to say “sell everything,” you say “we’re sorry all our representatives are assisting other customers, your call is important to us,” they hang up and get distracted, the market rallies, they forget about selling, you have saved them a fortune, good work.”

Good additional reading on this subject — Finance as Culture by John Luttig.

0% chance that my non-fintech friends would do this. 90% chance my fintech friends would do it.

I had to include this screenshot from Fold’s website because A.) it’s a good distillation of the hands-on-the-wheel money pitch (have fun getting rich) and B.) the statement “be rewarded for good financial behaviors” is absolutely bonkers when you remember that we’re talking about debit card purchases and a variable rewards structure that usually doesn’t pay out.

While Wedge is very focused on the control aspect of hands-on-the-wheel money, they distance themselves quite a bit from the fun aspect of it. Yes it offers crypto, but it also offers ETFs, which are the literal opposite of fun and excitement.

Having a profile picture of myself created in the style of a Jedi Master is the culmination of a lifelong dream. It’s all downhill from here.