Life Stage Products, Not Life Stage Marketing

Fintech is forcing banks to put down their marketing budgets and build more tailored products. This is a win for everyone.

Companies like to believe that their products are absolutely essential in the lives of their customers.

In some cases, they’re right. I’d give up 99% of my possessions before I surrendered my Disney+ subscription (or should I say my three-year old son’s Disney+ subscription).1

In other cases, this belief can blind companies from the truth — their products are not essential and their customers (even the seemingly satisfied ones) will leave them if given a good reason.

Banks fall into this latter group.

Whether they’re willing to admit it or not, banks sell enabling products. Consumers don’t want mortgages and credit cards and 401Ks; they want a nice place to live, the ability to buy stuff (including stuff they can’t quite afford), and to not work until they keel over and die.

The universal popularity of these outcomes has fueled banks’ collective delusion of their own popularity and indispensability, like the kid in high school who gets a car before everyone else and thinks it has nothing to do with their increased social status. This delusion is compounded by the regulatory moats that have shielded banks from serious competition for decades.

Banks have had a monopoly on the enablement of some of the most important and enjoyable moments in people’s lives.

Blessed with this monopoly, most banks did what most companies (and most people) do when they realize they no longer need to solve hard problems in order to succeed — they chose the easy path. Rather than continuing to innovate on the products that enable critical moments in their customers’ lives, they wrapped increasingly sophisticated marketing around the products they already had.

After all, if you know that customers have to get a product like yours from a bank like yours before they can do something that they really want to do, then the question becomes how do you capture those customers in that moment?

It becomes a marketing problem.

And the solution that banks landed on was Life Stage Marketing.

The basic formula (as executed by Bank of America a few years ago) looks like this:

Reorganize your website and marketing materials around the primary life stages that consumers go through and emphasize that you can help at every point along the way. Bonus points for feel-good stock photos and taglines like “life is a journey” and “life comes at you fast”.

Create key messages and marketing copy for each life stage. Double down on the emotion with more stock photos and taglines. Subtly introduce one of your standard products that might help customers during this life stage (no matter how tangential).

Drive customers down into your product acquisition funnel. Hope that they don’t notice that your list of relevant banking products is far shorter than the list of generic features and marketing tools and calculators that sound great, but don’t really do much to help.

Life stage marketing reminds me of a John Wooden quote — “don't mistake activity with achievement” — it makes bank marketing executives (and their bosses) feel like they’re doing something, but no real, tangible progress is being made with customers.

Fortunately, with the maturation of fintech we are finally starting to see some meaningful progress.

Life Stage Products

Banking-as-a-service (BaaS) busts the monopoly that banks have had on enabling important and enjoyable moments in consumers’ lives. Allowing any company access to the safe, regulated infrastructure that bank products are built on has expanded the opportunity for product developers to build new products that better serve the foundational needs of consumers at every life stage.

Fintech companies are seizing this opportunity.

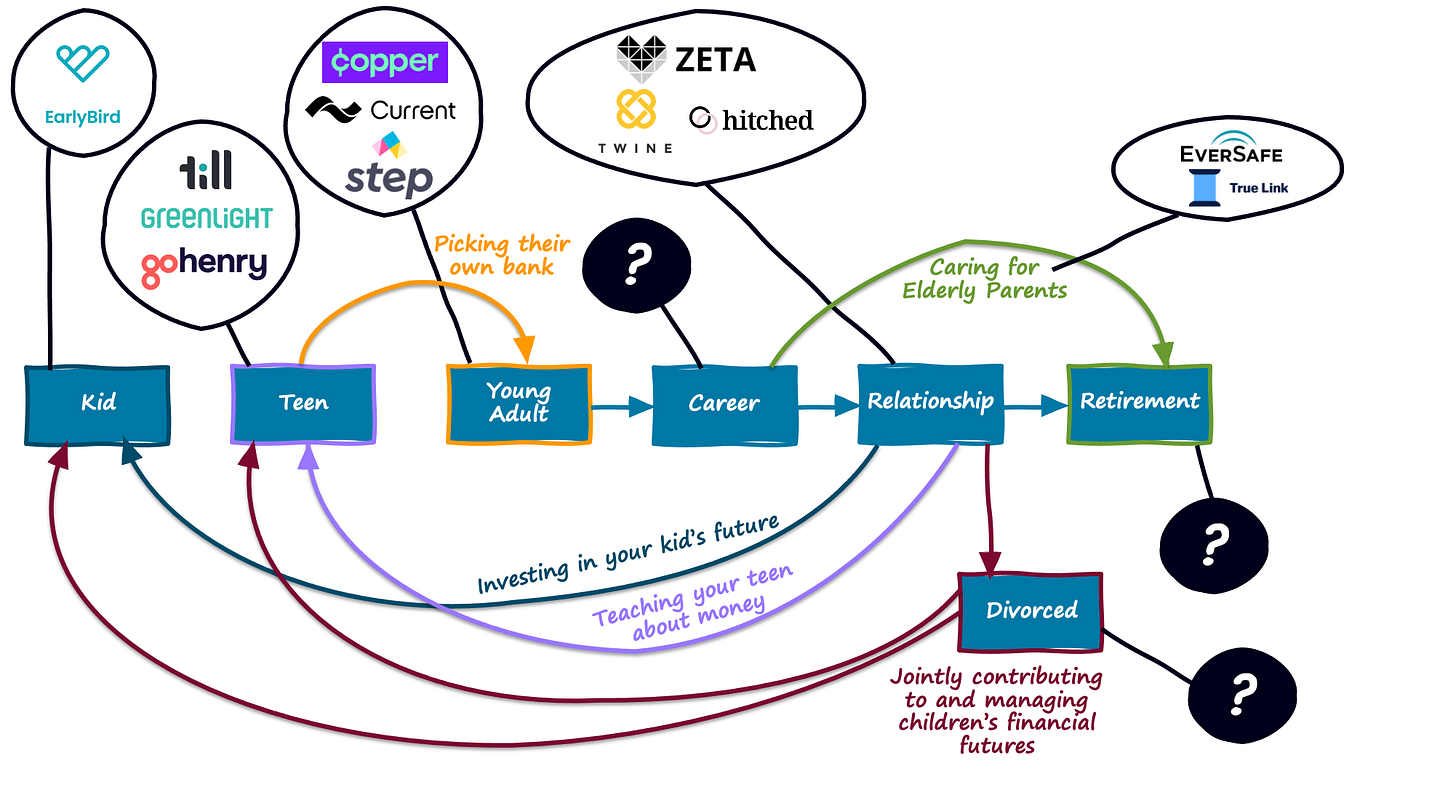

Neobanks like Current, Step, and Copper are building digital products for today’s young adults.

Fintech apps like Zeta, Twine2, and Hitched are designed for couples to jointly manage their finances and have more productive (less stressful) conversations about money.

GoHenry, Greenlight, and Till Financial are empowering parents to have similarly productive conversations with their kids while teaching them the basics of deposits, payments, investing, and credit.3

EarlyBird is going a step earlier, creating a service that lets parents, family, and friends jointly invest in a child’s financial future.

Eversafe and True Link have been focusing on protecting older consumers (fraud targeting the elderly is rampant) and enabling their children and family to help them manage their finances while maintaining financial independence.

It’s interesting to note, however, just how much white space remains.

While there are a decent number of solutions out there to help people prepare for retirement (Silvur) and end-of-life decisions (Trust & Will), there doesn’t appear to be any neobanks built for folks who’ve actually reached and are enjoying retirement.

I would also argue that the ecosystem of solutions for helping the elderly manage their finances while maintaining their independence and dignity is still underbuilt when compared to the booming landscape of Gen Z fintech.

Given the surge in financial relationship apps, it’s a bit surprising to me that we haven’t seen a similar product designed for divorced parents. The challenges of contributing to, negotiating over, and managing finances for children in families that have gone through divorce seems like a perfect fit for multiplayer fintech.

Digital banks for specific careers is perhaps the most interesting example of an underserved life stage product segment. We have the ‘fintech for freelancers’ category, with providers like Stoovo and Lili and more specific products built for online creators like Karat. But what about a digital bank for teachers? Or chefs? Or diplomats? Or any other long-term career field that could, conceivably, come with unique financial needs and challenges?

Interestingly, banks and credit unions might be a bit ahead of the curve here with USAA and PenFed excelling at serving military members and their families and, more recently, regional banks like KeyBank and Fifth Third investing in digital banking products for healthcare workers.

How Should Banks Respond?

In the short-term, look for opportunities to build, buy, or partner to create life stage financial products that can compete with the products being built by fintech companies.

Chase’s partnership with Greenlight, which allowed the bank to quickly introduce Chase First Banking is an instructive example. KeyBank’s acquisition and relaunch of Laurel Road as a digital bank for healthcare professionals is another.

In the long-term, banks need to develop a more nuanced strategy for banking-as-a-service.

Today, banks seem to view BaaS as either something to go all in on (let’s dump our consumer-facing brand and rent out our charter to everyone) or to avoid completely (we need to control the customer relationship and build all our products ourselves).

A middle course might actually be the best way forward.

One of my favorite Warren Buffett anecdotes is the story of him buying 5% of Disney back in 1966:

It cost us $4 million dollars. $80 million bucks was the valuation of the whole thing. 300 and some acres in Anaheim. The Pirate’s ride had just been put in. It cost $17 million bucks. The whole company was selling for $80 million. Mary Poppins had just come out. Mary Poppins made about $30 million that year, and seven years later you’re going to show it to kids the same age. It’s like having an oil well where all the oil seeps back in.

The genius of Disney is that it has taste. It creates great entertainment products itself, but it also recognizes and aggressively acquires outside artistic excellence that has lasting appeal to consumers across demographics. After all, Disney didn’t dream up Mary Poppins or Toy Story or Star Wars or Iron Man, but now all of those properties are driving customers through the integrated entertainment ecosystems that Disney has built and monetized (Disney+, Disney Theme Parks, etc.)

What if a bank created a curated ecosystem of financial products — some built in house, but most built by fintech companies and all operated on the bank’s BaaS infrastructure — that addressed a range of interrelated customer life stages? Each product would stand on its own, innovating on its roadmap and attracting new customers as older ones aged out. However, the bank could also facilitate the streamlined cross-sell of different products within their portfolio where it made sense.

Sponsored Content

Even for experienced compliance teams, navigating the landscape of security and privacy compliance requires a huge amount of research and operational overhead. From SOC 2 to ISO 27001 to HIPAA and PIPEDA, fintech companies have been increasingly relying on external compliance firms to help streamline their end-to-end process.

Laika is the only solution that completely eliminates the friction and dependence on third parties. Their platform was built as a one-stop solution from implementation to an integrated audit experience. With Laika, you can get an audit without logging into some random portal or exporting your data to provide it manually to an auditor.

Check out how they’ve helped hundreds of businesses go from zero to compliant below:

Short Takes

Building a small business super app.

Square is launching business banking accounts.

Short take: Most of the discussion of ‘super apps’ in fintech centers on consumer fintech, but the interesting super app battle is actually in small business fintech. This is a big step for Square in its escalating competition with Intuit, Shopify, and PayPal.

BNPL for B2B.

Revenue-based financing platform Capchase launched its own buy-now-pay-later platform.

Short take: You know BNPL is hot when revenue-based financing (a hot category itself) is getting the distracted boyfriend meme treatment.

Fintech’s next target: tax prep.

TurboTax’s parent company, Intuit, left the IRS’ Free File program.

Short take: Intuit has a long and terrible history of trying to prevent Americans from filing their taxes for free. I would very much like to see an onslaught of fintech companies focused on disrupting the tax prep market and making Intuit’s life more difficult.

Alex Johnson is a Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies.

Twitter: @AlexH_Johnson

LinkedIn: Linkedin.com/in/alexhjohnson/

Whenever my son wants something and I ask him where he’s going to get the money to pay for it he just says “the bank”.

If any fintech startup is looking to burn a little capital in order to acquire the unprofitable, but highly desirable Gen Alpha consumer, I’d be happy to refer you.

Interesting backstory on Twine: it was acquired by John Hancock in 2015, well before multiplayer fintech was a hot category.

You can either build a product for parents and their kids or a product for teenagers and young adults. Even though both products serve teens, the brands and product features are very different. This is why Greenlight will never be Current and Current will never be Greenlight.