Underbankers

Success isn't defined by how many of your products a customer owns.

Here’s a question that sits at the heart of a lot of different trends and topics in financial services — from the emergence of fintech to the importance of the Community Reinvestment Act — how well do banks in the U.S. serve consumers?

We typically answer this question in one of two ways.

First, we look at how satisfied customers are with their banks.

Despite what the first slide in most fintech pitch decks1 would have you believe, a vast majority of customers are satisfied with their banks:

97.3 percent [of banked American households] were very or somewhat satisfied with their primary bank.

You can come at this question in whatever direction you want:

60% of Americans say they’ve experienced exceptional service from their current bank.

The basic answer stays the same — Americans are generally quite satisfied with their banks.

The second way to look at this question is to quantify the number of Americans that banks aren’t serving — the unbanked and underbanked.

Again, the available data here won’t thrill those who think that banks are terrible:

The proportion of U.S. households that were unbanked (i.e., the unbanked rate) in 2019—5.4 percent—was the lowest since the survey began in 2009

And while the FDIC didn’t quantify the number of U.S. households that are underbanked (that is, households that have a deposit account, but also use alternative financial products like payday loans) in its most recent survey, it seems likely that the last estimate we have from the FDIC back in 2017 — 18.7% — has decreased as well.

So, to return to the question — how well do banks in the U.S. serve consumers? — it would appear that the answer is very well. Americans that work with banks are very satisfied and the percentage of consumers that don’t work with banks has been decreasing steadily and is now at an all-time low.

One small problem.

When we measure the rate of unbanked and underbanked consumers, we do so under the implicit assumption that the goal is to get consumers to become fully banked. As if owning every product a bank offers today is synonymous with having all of your financial needs met.2

Customer satisfaction surveys suffer from a similar flaw. When we ask consumers if they are satisfied with their current bank we are, in practice, asking them to make a comparative judgment — compared to what you would expect from an average bank, how satisfied are you with your bank?

We’re missing something important.

We should be trying to understand, holistically, how well customers feel they’re doing financially and what they think they need in order to improve. We should be asking questions like are you achieving the financial future that you want? And is your bank helping you achieve that financial future?

It turns out when you ask those types of questions you get very different (and much more instructive) answers.

FICO recently commissioned a survey of U.S. consumers, in which it asked:

What is crucial to the future of your financial success?

Only 1% of respondents mentioned a bank.

1%.

The other 99% of their answers covered a huge range of financial needs that are, largely, unaddressed by current financial products and services.

Given this, I think we need to repurpose the term ‘underbanked’. It shouldn’t be a designation that we assign to consumers based on the percentage of traditional bank products that they own. It should be a label we apply to banks (and fintech companies) that indicates how well (or poorly) they are addressing the entirety of consumers’ financial needs.

For companies that are failing to fully address consumers’ financial needs, I suggest a new term — underbankers.

And judging by the research, every bank and fintech company in the U.S. is, to one degree or another, an underbanker.

Americans’ Unmet Financial Needs

When we stop trying to understand consumers’ financial needs through the prism of bank and fintech companies’ current product offerings it becomes much easier to see the root financial problems that consumers continue to struggle with.

These problems (and the solutions that consumers think they need to address them) can be broken out into the following categories:

How do I use these powerful tools you’ve given me?

Max Levchin once described credit cards as:

the most powerful of all power tools, which also has the obvious consequence of being the most likely way for you to saw off your own leg.3

It’s an apt analogy (although not a good literal comparison … I’ve yet to see a metal credit card shaped like a tiny saw).

The most popular answer to the survey question that FICO asked — What is crucial to the future of your financial success? — was “making smart decisions when considering big purchases”. A couple of spots down on the list was “getting a better handle on debt — when to use it and how to pay it down”.4

What’s striking to me about these responses is that consumers aren’t expressing a need for help facilitating transactions. They don’t need a more convenient payment mechanism or easier access to credit. Most of them already have that. What they need is help using these power tools (to borrow Mr. Levchin’s phrase) in a safer, more productive way.

Indeed, you could argue that the financial industry’s obsession with creating more and more convenient products to facilitate financial transactions is antithetical to consumers’ desire to slow down and make better decisions on big purchases and the use of debt.

Work smarter not harder.

Consumer advocates wring their hands when they see statistics like this:

64% of Americans don’t have a written financial plan.

And this:

36% of Americans don’t have a monthly budget.

But the reality is that most consumers don’t want to do a lot of work to make money work well for them. They want the insights that come from budgeting and financial planning, but not the hard work.

According to FICO, 73 million Americans believe that “learning if you’re ‘on track’ for the lifestyle you want (& how to adapt if you’re not)” is crucial to the future of their financial success.

More money, fewer problems.

Banks and fintech companies compete fiercely for wealthy customers. SoFi has its HENRYs. Chase has the adherents to the cult of Sapphire Reserve. And everyone is obsessed with the impending greatest wealth transfer in human history.

It makes sense. The wealthier a customer is, the more profitable they generally are.

What doesn’t make sense is the lack of interest that most banks and fintech companies seem to have when it comes to helping their customers earn more money. Not get a better return. Not save more money. Earn more money.

According to FICO’s research, 71% of Americans say they think about making more money a few times a week or more and 71 million Americans said that “figuring out how to earn more by getting a higher-paying job”5 is crucial to the future of their financial success.

Traditional banks and challenger banks offer checking accounts. They compete to get customers’ direct deposits from their employers. And yet they generally don’t compete to help those customers earn more from their employers.6

Why not?

Comparison is the thief of joy.

Banks and fintech companies want to motivate customers to use their products as much as possible. Do you know what is a great way to motivate customers? Giving them an unrealistic image of wealth and luxury to compare themselves to:

Mr. Kelly’s Instagram account highlights a lifestyle of high-price travel that rewards cards can pay for, boasting photos of him in a hammock in Bora Bora and views of Cape Town from a luxury hotel.

Brian Kelly (The Points Guy) is an enormously influential player in the credit card business because of the awesome influence he wields (through his website and social media accounts) to motivate credit card acquisition and utilization.7

But that influence takes a toll on consumers, who often feel forced to make unwise financial choices in order to project a lavish lifestyle through their social media accounts. Here’s an illuminating quote from an interview FICO conducted with a bank customer:

Through social media, I’m able to show I can live a little lavishly too, but that’s still not always my reality. I think, “I spent this much money on this meal that I’m posting on social media, but that could have been my groceries for the week. One meal could have been a whole weeks worth of food.

Little surprise then that 86 million Americans, when asked what they considered crucial to the future of their financial success, said “developing a healthier relationship between money and happiness”.8

This is a Product Opportunity

It’s tempting to dismiss (admittedly abstract) needs like “developing a healthier relationship between money and happiness” as valid, but not indicative of a specific product need that consumers would be willing to pay for.

But that would be a mistake.

In the FICO survey, consumers were asked if they would pay for services to address the needs that they considered crucial to their future financial success.

Many Americans said yes.

Sponsored Content

Join Fintech’s largest online interactive community! Introducing Fintech Spring Meetup — a new online event designed to get you 3 months’ worth of meetings in just 3 half-days. Connect with the People You Know & Meet the People You Don’t. No Webinars. No Content. Just 10,000+ Meetings with 1,000+ participants. Get Business Done! Learn More & Join.

Short Takes

(Sourced from This Week in Fintech)

Lions and interest and fees, ohh my!

MoneyLion will merge with Fusion Acquisition Corp. at a post-transaction enterprise value of $2.4 billion (and an estimated equity value of $2.9 billion from the contribution of up to $526 million in cash proceeds from the transaction).

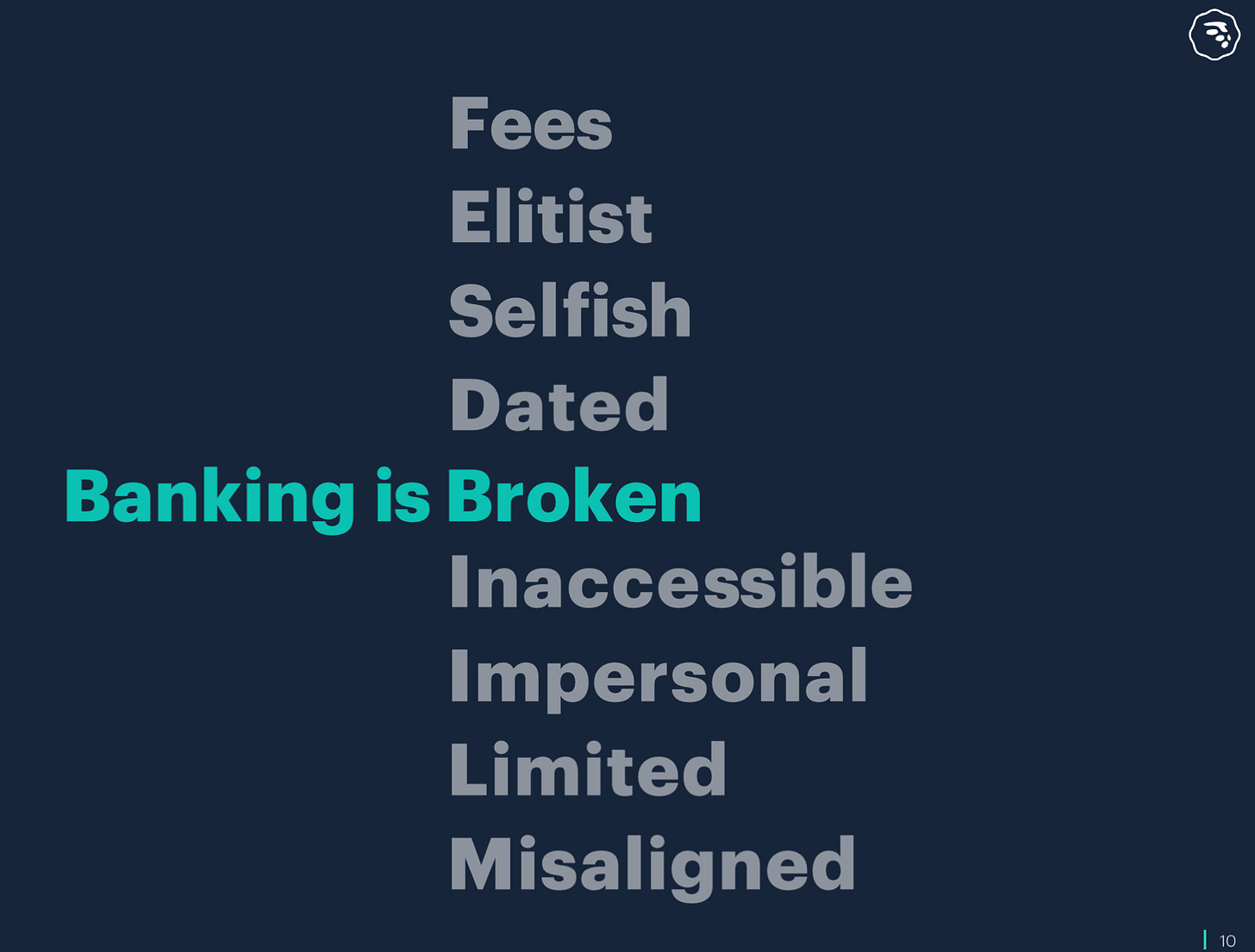

Short take: I ranted about this on Twitter and Clubhouse last week, but raising money by claiming that banking is broken while charging customers as much as $400 for a $1,000 credit builder loan is 🤬

Lending a hand

US banks continue to lend less and less of their money as a share of assets.

Short take: Big banks are pushing back on fintech and technology companies, encouraging regulators to take a closer look at business practices that they think are unfair. This argument won’t win a lot of hearts and minds if those same big banks don’t lend out some of the cash they’ve been getting from the Fed.

Super apps for everyone

PayPal plans to flesh out Venmo this year to look more like a neobank - with budgeting, savings, and bill pay - along with a merchant-funded offers platform via Honey and a cryptocurrency trading service via Paxos.

Klarna moved into N26’s territory, launching consumer bank accounts in Germany.

Djamo is a fintech player building a WeChat-style financial superapp for francophone Africa.

Short take: Seems like every fintech company is somewhere along the path of building out their super app. PayPal is following (and expanding on) Cash App’s playbook. Klarna is making a big pivot from a spending-oriented value prop to add deposits. Fintech startups in less mature markets like Francophone Africa are building the entire super app from the ground up.

Alex Johnson is a Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies.

Twitter: @AlexH_Johnson

LinkedIn: Linkedin.com/in/alexhjohnson/

OK, technically this is the tenth slide from Money Lion’s investor deck:

It’s a bit ironic hearing Max Levchin critique credit cards because they make it too easy to spend recklessly given the massive amount of merchandise that Affirm has helped merchants move over the last couple of years.

Lenders tend to excel at helping consumers acquire debt (account opening) and pay it back (collections), but there’s almost no focus on advising consumers on how to use debt productively.

This includes figuring out how to make more money at their current job, getting a new (higher paying job), and changing fields to earn more or find a job they enjoy more.

Fifth Third is an admirable exception. The bank partnered with Steady last year to help its customers find work and maximize their earnings opportunities.

As I’ve written before, credit cards are (low key) terrible.

Required reading on this topic: Happy Money.