Fintech Fire Alarms: January, 2022

Fashion-forward fintech, the evolution of the credit bureaus, and more.

One fifth of all venture capital dollars invested in private companies globally in 2021 went to fintech companies, so I’m not sure why I was expecting January to be somewhat chill (maybe cause it’s so chilly here in Montana?) but … well …it wasn’t.

January was a blockbuster month for fintech, so without further ado I present five fintech trends that caught my eye over the last month:

Fashion-forward Fintech

The Neobank-ification of QuickBooks

The Credit Bureaus Evolve

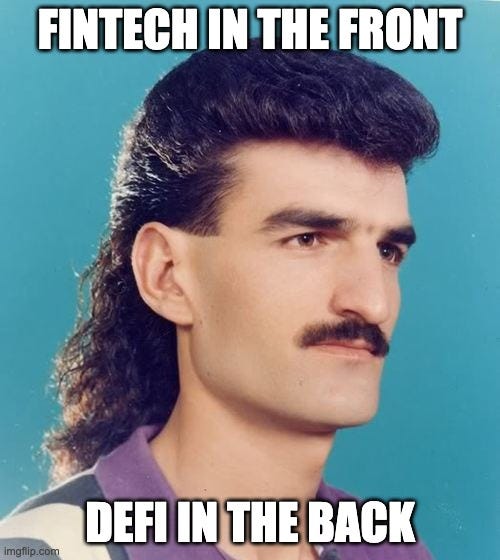

The Delicate Dance of the DeFi Mullet

Better Banking for Lower-Income Americans

1. Fashion-forward Fintech

What happened?

Twig, a circular economy fintech, picked up $35 million in Series A financing.

Responsible, an embedded finance platform for fashion, raised a $6.6 million seed round from Barclays.

So what?

If your goal is to start a bidding war between VC firms to fund your Series A, you literally cannot come up with a better description of your company/product than this:

[Olympic ice skating TV commentator voice]: Notice those buzzwords! See how gracefully it combines fintech with crypto and ESG? Magnificent.

Let’s set aside Twig’s marvelous marketing copy for a moment1 — the underlying concept here is very interesting. It’s essentially a bank account that allows you to upload a list of your possessions (clothes and electronics, particularly) and instantly liquidate those possessions whenever you want. Think Cash App + iBuying except for retail items rather than real estate.

Responsible is similar — buying back used clothing from the owner instantly — but it relies on an embedded distribution model via an e-commerce plugin.

When I hypothesized, in a prior newsletter, that that the atomization of banking would lead to new and wildly unique financial products, this is the kind of thing I was thinking of.

2. The Neobank-ification of QuickBooks

What happened?

Heard raises $1.3M to help mental health professionals run their own business.

So what?

OK, I’m cheating here a bit. This company didn’t raise in January. The news is from back in March of 2021, but I just heard about Heard from a recent edition of Simon Taylor’s Fintech Brain Food newsletter and I wanted to write about them.

Heard provides accounting, payroll, and tax management services (software and human accountants) for private mental healthcare practices.

What’s interesting to me is that Heard is following the same basic playbook that niche neobanks like Daylight and First Boulevard are using — a combination of software and people focused on solving the unique financial needs of a specific, durable customer segment. The difference is that heard is starting with accounting rather than banking because, as Simon put it well in his newsletter, “accounting is the operating system of SMBs.”

That’s interesting! That means, in theory, that segment-specific startups could attack SMB accounting incumbents like QuickBooks in the same way that Daylight and First Boulevard are attacking Chase.

Watch this space.

3. The Credit Bureaus Evolve

What happened?

Equifax, TransUnion, and Experian are all adding support for BNPL providers to furnish repayment data.

Experian is planning to launch a tool — Experian Go — to allow credit invisible consumers to create their own credit reports.

TransUnion will enable consumers to give crypto lenders access to their personal credit data.

So what?

Two forces are, simultaneously, pushing the credit bureaus to evolve.

One is regulation. To say that the CFPB is intently focused on credit reporting is underselling it:

And this pressure is encouraging the bureaus to make changes to help consumers get credit for the positive, credit-related things they are already doing.

However, the other force, which we don’t talk about enough, is business. The credit bureaus are for-profit businesses. Many of the new innovations they introduce are, understandably, designed to help them make more money from lenders or from consumers directly.

What’s most interesting to me is how these forces overlap and occasionally come into conflict. For example:

Experian is keeping its BNPL repayment data separate from its traditional credit data, in order to “protect consumer credit scores from immediate negative impact”. That’s very consumer friendly, but I wonder if this will make it more difficult for lenders to incorporate this data into their decisioning processes (which would be bad for business)?

Experian Go is the first consumer-focused mechanism that I’m aware of for triggering the creation of a new credit report. Good for credit invisible consumers! But also, maybe, really good for fraudsters looking to create synthetic identities?2

TransUnion is letting consumers take their TradFi credit histories into DeFi. That has the potential to be useful for consumers and DeFi lenders. Will TU allow TradFi lenders to get visibility into consumers’ DeFi lending histories?

4. The Delicate Dance of the DeFi Mullet

What happened?

So what?

I’m going to go out on a limb and guess that there’s only one company in the world that is partnered with both TurboTax and Compound Labs.

Current is trying to build what it calls ‘hybrid finance’ and what fintech Twitter tends to call the ‘DeFi mullet’ — a banking service that seamlessly combines the intuitive user experience of fintech with the infrastructure and yield advantages of decentralized finance.

One of the reasons this concept is so hard to build is that it requires companies to put customer value above ideology.

If you’re a web3 person, it’s likely that you think web3 is the answer for pretty much everything and that software products like TurboTax are unrepentant evil:

That’s a perfectly understandable perspective!

It’s also understandable for web2-era fintech folks to look at web3 and conclude that 99.99% of it is made up of scams and speculation.

What’s hard to do is to set aside your personal feelings and build the best possible product for your target customers, drawing equally from web2 and web3 toolboxes along the way.

5. Better Banking for Lower-Income Americans

What happened?

H&R Block launched Spruce, a digital bank for low-income Americans.

Walmart is acquiring One and Even with the intention of creating a digital bank for customers and employees.

So what?

If you really want to get better digital banking solutions in the hands of lower-income consumers, you need to obsess over distribution.

It’s relatively easy, today, to build many of the banking features that these consumers need (early access to paychecks, automated savings, earned wage access, etc.)

However, as Nik Milanović3 recently pointed out on Twitter, too many of these features are currently offered by fintech apps that expect users to find them rather than being embedded in the places where these consumers already are:

I’m personally more bullish on Walmart than H&R Block, but both are great examples of companies with built-in distribution advantages offering digital banking solutions to the exact consumers fintech most needs to help.

Alex Johnson is a Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies.

Twitter: @AlexH_Johnson

LinkedIn: Linkedin.com/in/alexhjohnson/

Though, when you have a moment, you should check out their website. It is gloriously different than anything else in fintech.

I’d be shocked if Experian wasn’t intently focused on this concern and taking steps to address it.