The Most Fundamental Problem in Financial Services

If your products aren't making your customers happy, nothing else matters.

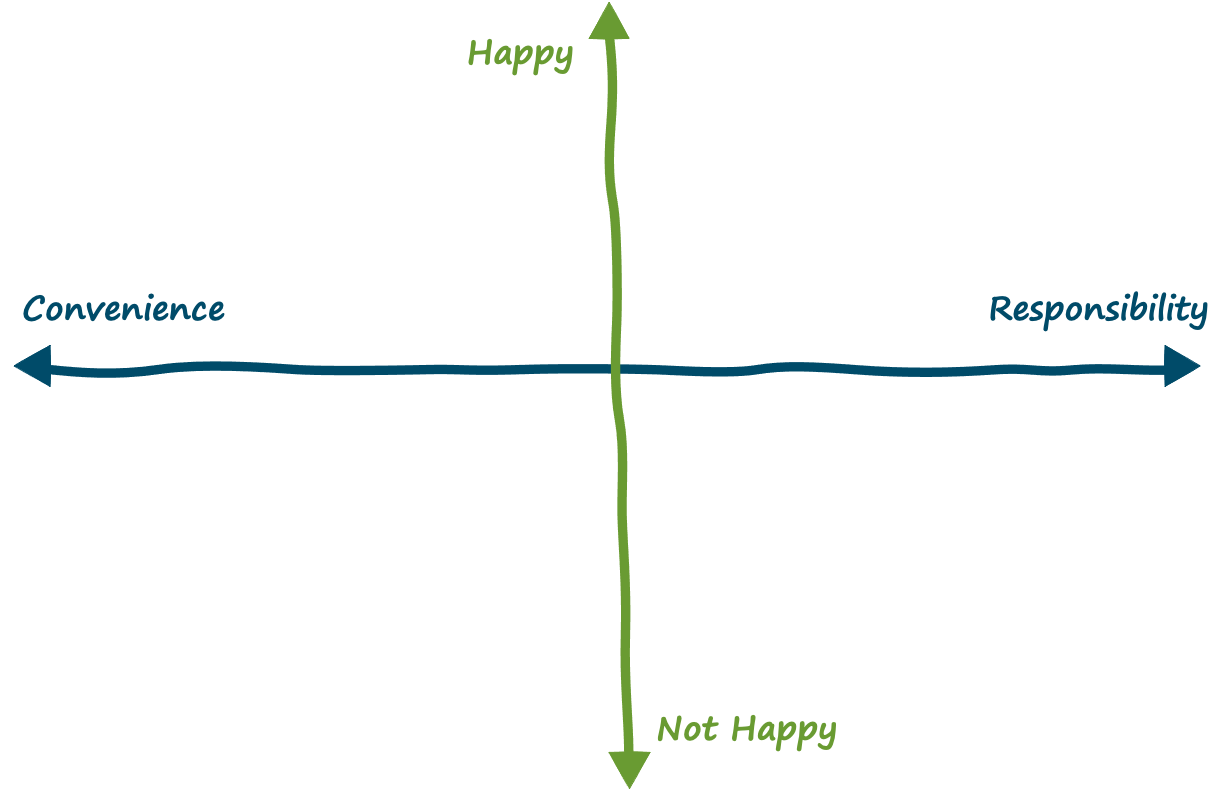

A lot of the bank — fintech debate can be compressed into a continuum that looks something like this:

Should we be removing friction and making it easier for consumers to access and use financial services? Or should we be introducing thoughtful points of friction into those financial services in order to encourage responsible usage and drive better long-term outcomes?

What’s best for the consumer?

The “correct” answer tends to seesaw back and forth, as the prevailing sentiment about a particular financial product (and its alternatives) changes.

Take the credit card (and the competitive products that have tried to disrupt it over the last 25 years) as an example:

Credit cards are tempting users into debt. Debit cards are better!

Debit cards aren’t safe to use online and they have no rewards. Credit cards are better!

Credit cards aren’t transparent and those fees are outrageous. BNPL is better!

BNPL is tempting users into debt and is hard to manage. Credit cards are better!

Besides being exhausting, this debate isn’t very useful.

It’s not useful because it ignores a simple, but deeply important truth — what’s best for the consumer is whatever makes them happy.

The reason that most financial advice feels paternalistic isn’t because the advice itself is bad. It’s because it’s generic. The assumption underlying most financial advice is that everyone is trying to achieve the exact same outcome and thus there will be, for every financial question, an objectively “correct” answer.

However, if we accept the premise that the ultimate purpose of financial services is to maximize individual utility (i.e. happiness), then we must also accept that there is no one right answer. Happiness is subjective.

This tweet (justifiably) provoked a ferocious backlash when it happened:

However, the thing that always struck me about it was the lack of context surrounding the question it was asking — why is my balance so low?

Purely as a matter of accounting, this is an easy question to answer — your balance was X, then you bought a coffee, went out to lunch, and grabbed a cab, and now your balance is Y.

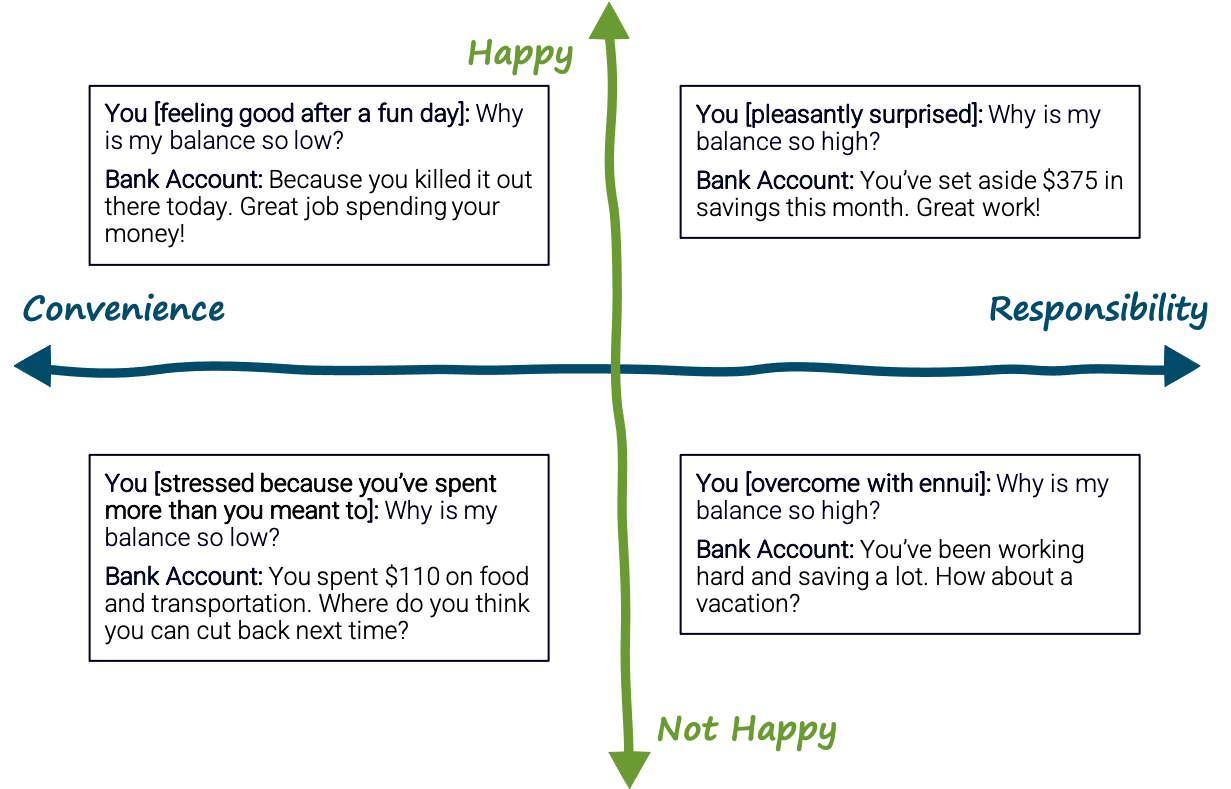

But the real question that a customer is asking, when they check their balance, is are my financial decisions making me happy?

And when you layer this emotional context over the accounting question, the answers become more complex and much more useful.

Bank and fintech apps aren’t designed to provide answers like these, which is a shame because consumers are desperate for them.

A Healthier Relationship

In a survey conducted last year, 1,002 U.S. adults were asked “what is crucial to the future of your financial success?” The question was specifically tailored to get respondents thinking about their overall financial needs, independent of the products and services that banks and fintech companies offer today.

The second most popular response — provided by 86 million Americans — was “developing a healthier relationship between money and happiness.”

When asked why this was so important, consumers consistently cited the negative feelings that resulted from comparing themselves, financially, to others. Indeed, 58% of Americans reported having felt disappointed with themselves or embarrassed when they saw someone else’s financial status or lifestyle.

A quote from one survey respondent elaborated on why it’s so hard to avoid the temptation to compare:

It probably has a lot to do with social media.

I’m able to see people that are around my age, people that I’m friends with or used to go to school with, buying houses and they’re paying off their cars. And so I see that, and I’m not in a place to buy a home right now or pay off my car.

I know you’re not supposed to evaluate yourself based off of what I see people posting online, but I do.

And instead of helping consumers deal with this comparison-fueled anxiety, many banks and fintech companies are pouring gas on the fire.

In banking, the worst offenders are the big credit card issuers that partner with influencers like Brian Kelly (The Points Guy) to associate their products with an unrealistic image of wealth and luxury, which their customers will inevitably compare themselves to:

Mr. Kelly’s Instagram account highlights a lifestyle of high-price travel that rewards cards can pay for, boasting photos of him in a hammock in Bora Bora and views of Cape Town from a luxury hotel.

In fintech, the cutting-edge of FOMO marketing is being practiced by the big BNPL providers which, despite their competitive positioning against credit cards (more honest, transparent, and affordable), are all slowly morphing into shopping apps that just so happen to provide loans.1

To be clear: shopping isn’t inherently bad and financial services providers (credit card issuers, BNPL companies, and others) that streamline the shopping/checkout/payment process are addressing an important problem for their customers.

However, as an industry, we can’t stop there. We can’t just focus on solving for these specific pain points and then shrug and say “the rest is up to our customers”. We can’t optimize our apps for engagement and then assume that more engagement is going to be better for both our bottom lines and our customers’ financial, physical, and emotional wellbeing.

We need to focus on maximizing each individual customer’s utility. Not just in our marketing materials or in our annual report to shareholders, but in the core design of our products.

We need to productize utilitarianism.

Fintech + Behavioral Science

The good news is that the agile, iterative approach to product development that fintech has brought to financial services is perfectly suited to achieve the vision of a more utilitarian consumer finance experience.

All we need are some new hypotheses to test out for improving customers’ happiness. Fortunately, the field of behavioral science has a rich library of research to draw from.

According to Dr. Elizabeth Dunn, a professor in the Department of Psychology at the University of British Columbia and a leading expert on the relationship between money and happiness2, “as behavioral scientists, we’ve had a great opportunity to figure out some of the overarching principles that can help people live better lives with respect to their money, but with fintech we can actually build those principles into products that people use every day and test them on an individual basis and rapidly iterate from there.”

For banks and fintech companies interested in pursuing this vision, here are a few suggestions for getting started:

Make happiness an actionable metric. As Dr. Dunn points out, “what is measured is valued. When it comes to happiness, we think of it as having three core components: life satisfaction, positive emotion, negative emotion. Everyone experiences negative emotion, obviously, but we want a higher ratio of positive to negative emotions on a daily basis and for people to move, slowly over time, to higher levels of life satisfaction.”

What would it look like to measure this and feed the insights back to the customer? When I was recently asked what product I would build if I was starting a neobank, I said Personal Financial Happiness Management — a PFM-like interface that overlays a person’s financial accounts in order to help them quantify which financial behaviors and milestones make them happiest (i.e. contributes to an increase in positive emotion and a decrease in negative emotion) and then nudges future financial decisions in the right direction.

The beauty of this type of solution is that it would create the proper context to have productive, nonjudgemental conversations with customers about their everyday financial decisions, a point Dr. Dunn makes as well, “we define happiness as being about people’s own emotional experiences. If you center on that, there’s no room to bring your own judgements into it. It goes from ‘don’t buy that avocado toast!’ to ‘this avocado toast is a real high point in your day! You’re spending GREAT on that.”

What you see is what you feel (WYSIWYF). How information is presented to consumers impacts their emotional response to it. This hasn’t historically been a consideration in the design of bank and fintech mobile apps, but it could be and it can have a significant impact. Dr. Dunn elaborates, “what we see when we log in to our bank account matters. For me, when my mortgage shows up under my list of accounts it says ‘negative $480,000’ but I know that rationally I have a low interest rate and my payment is reasonable, but it’s displayed in this negative way. Similarly, there’s some recent evidence that suggests that the amount of cash people have on hand — the amount they see in their bank account when they log in to check their balance — is more strongly related to their happiness than their overall net worth. There’s something about being able to feel like ‘ohh, I have enough’ that is really valuable.”

Beware of fully autonomous finance. Self-driving money is an enduring obsession in bank and fintech companies’ product roadmaps for a good reason — it can solve a lot of problems (although it’s not as easy to build as many think). That said, the concept raises an important question — how does the automation of financial tasks and experiences impact happiness? According to Dr. Dunn, “a fundamental principle in behavioral science is the law of least effort — the least effortful action that accomplishes the goal will be the one that is taken. However, when it comes to saving, one thing I’m curious about is whether it’s helpful to have a little agency. You want people to identify themselves as savers, the type of people who save. If we automate too much of that process, does that cause people to see themselves differently? If not, will they revert back to other behaviors when they encounter a speed bump? Charitable giving is another area. Setting up monthly automatic donations may undermine the emotional benefits that people get from charitable giving. To the extent that they no longer feel connected to that positive action, it can be problematic.”

Don’t get obsessed with engagement. On this topic, Dr. Dunn is blunt, “Rate of engagement is a terrible metric because engagement isn’t inherently good. Sometimes behavioral science gets harnessed in not the best ways.”

I agree wholeheartedly. As I’ve argued before, in the absence of other metrics, bank and fintech product developers will tend to default to engagement as the metric they focus on optimizing and that can lead to some weird (and often bad) product design choices. The more that we democratize access to new financial services capabilities for product developers, the more we risk this problem growing worse.

Make savings satisfying. Instead of further leaning into the downward spiral of Instagram-fueled consumption, banks and fintech companies should apply their marketing and design savvy (and the accompanying budgets) to making the decision to save more compelling. Unsurprisingly, Dr. Dunn has some ideas, “Right now, savings are very emotionally pallid. The typical savings account is completely unexciting. Can we take everything we know about behavioral science, bringing each small behavioral change to life in a vivid way, and apply it to savings? For example, give people a concrete savings goal and every time they save a little bit for that trip to Japan or that new kitchen, have an instagram-like photo pop up on their phone telling them ‘you just got closer’. If you can represent that progress in a visual and emotionally evocative way, you should be able to make those little small actions that you make towards that goal more emotionally rewarding.”

TL;DR

The most fundamental problem in financial services is that people don’t know how to use money to make themselves happy. This problem unites consumers demographically and socioeconomically in a way that almost nothing else does.

Financial services providers have everything they need to solve this problem.

The question is who will build it?

Sponsored Content

With the increasing adoption of digital and cloud technologies, compliance is non-optional for growth. Every innovative company benefits from a SOC 2 report to ensure proper information security, particularly in the fintech space.

Combining a modern platform with subject-matter expertise, Laika helps hundreds of companies build and manage their security programs, pass thousands of audits, and respond to security questionnaires. Building your security posture doesn't have to be painful with the right team by your side. Learn more about Laika below.

Short Takes

(Sourced from an incredible fintech news ecosystem)

Stripe is the Latest ‘Stripe for Identity Verification’

Stripe launched a new product called Identity — a self-serve tool that companies can use to verify user identities, with Stripe managing the customer data in an encrypted format, using computer vision and machine learning to “read” and match up government IDs with live selfies.

Short take: That sound you hear is every ID&V vendor simultaneously updating their competitive battlecards with phrases like “one company can’t be good at everything”.

Playing All the Seats

JP Morgan is bucking the trend by continuing to open more Chase branches, with 200 new ones open and 200 to go.

Short take: When it comes to topics like digital transformation and right-sizing branch networks, the big banks are kinda like the rich person at the casino playing all the seats at a blackjack table — they have so many resources they can afford to pursue wildly different strategies in parallel.

Here Comes the Pivot

Klarna released an app that allows UK users to use their installment loans at any online retailer.

Short take: The next logical step for the established BNPL providers is to move beyond their existing merchant partnerships and create ongoing relationships directly with consumers. One wonders how the merchant partners will react 🧐

Featured Question

It was recently suggested that the fonts used in this newsletter could stand to be modernized. That’s not going to happen. Substack doesn’t provide a lot of flexibility on the font front and even if it did … this isn’t a democracy.

That said, it did make me curious — if you could pick one font to be the official font of fintech, which would you choose?

Alex Johnson is a Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies.

Twitter: @AlexH_Johnson

LinkedIn: Linkedin.com/in/alexhjohnson/

She literally (co-)wrote the book on it and is an advisor to a company called Happy Money.