What Do Customers Actually Want Out of Fintech?

Product roadmaps in fintech seem to be converging. This could be a problem.

Here’s a thing that I’ve noticed — the easier it becomes for later-stage fintech companies to raise money, the easier it becomes for me to accurately predict those same companies’ product roadmap announcements.

Consequently, in the current venture investing environment, this predictive ability of mine has become supercharged.

According to data from CB Insights, there were 439 mega investment rounds ($100 million or more) in Q3 of this year, up from 173 in Q3 of 2020.

And over approximately the same time frame, the following fintech product announcements were made:

Ramp launched free AP automation capabilities for its customers.

Corporate spend management startup Jeeves launched Jeeves Growth, a revenue-based financing solution in any currency.

Nubank launched a corporate credit card, in its first foray into business banking services.

Stripe and Klarna entered a strategic partnership to enable any merchants using Stripe to offer buy-now-pay-later.

Upgrade announced that it is adding BNPL loans to its cards.

MoneyLion announced a BNPL product.

British challenger banks Revolut and Monzo piled into the BNPL space with their own offerings.

Investing exchange Public launched crypto trading.

MoneyLion launched a crypto investing service.

Acorns announced that it is building a crypto investing product.

PayPal added a savings account and other features like crypto to its payments superapp.

Affirm announced that it is launching crypto and debit products.

None of this was especially surprising or difficult to predict.

If you’re a well-funded BNPL company, you’re probably going to partner with e-commerce infrastructure companies and add banking and crypto capabilities to your app. If you’re a neobank, you’re likely going to add crypto and BNPL. If you’re building finance solutions for corporate customers, you will be tempted to converge towards a combination of AP/AR automation, corporate cards, and revenue-based financing in your product roadmap.

Basically, everyone is planning to do what everyone else is doing.

It’s the Spider-Man Pointing Meme-ification of fintech.

It’s understandable. Investors expect their portfolio companies to ship. For founders, the pressure to show that you are constantly pushing out new products and product features is intense and, let’s be honest, there are only so many novel ideas that your product development team is going to come up with in a quarter. And, by the way, those novel ideas take significant time to build!

By contrast, copying existing products and product features in the market is fairly straightforward. If you can’t backwards engineer it just by looking, there’s probably some senior product manager out there who’s built it before for you to hire. Or you can acquire a company that’s already built it. Or you can buy it from one of the myriad new fintech infrastructure providers that have popped up over the last few years.

The problem with this fast follower approach to product innovation is that it risks becoming decoupled from what should always be our North Star in fintech product development — what does the customer want?

In that spirit, I thought it might be helpful to look at three of the hottest fintech trends at the moment — BNPL, green banking, and super apps — through the lens of what customers actually think about them.

BNPL

What’s happening?

There’s a lot happening in BNPL right now. Here are a few of the most important trends:

Neobanks’ new feature. As mentioned above, established neobanks in the U.S. (MoneyLion) and the UK (Revolut, Monzo, Curve) have all introduced (or are planning to introduce) BNPL as a feature within their apps.

Banks and the card networks give it another go. Version 1 of banks’ response to BNPL — the ability for cardholders to retroactively convert large transactions into installments — hasn’t worked. No surprise there. What will be interesting is seeing what banks (and the card networks) come back with for version 2. Capital One’s upcoming BNPL product should give us a good idea of whether bank BNPL solutions have a chance to succeed. It’ll also be interesting to see how the card networks adapt to BNPL. I wouldn’t be surprised if a new, specific tier of interchange fees for BNPL transactions is introduced at some point.

Shopping apps. The established BNPL providers — Affirm, Klarna, and Afterpay — are all in the process of trying to convert one-time customers acquired through merchant partners into recurring customers that start the shopping journey in their apps.1 To accomplish this, these providers have all made product discovery and shopping a central experience within their apps. This impulse is likely what motivated PayPal to flirt briefly with the idea of acquiring Pinterest — moving further up the commerce funnel.

Closed-loop networks. BNPL is also proving to be a crucial bridge between the merchant and consumer sides of payment providers’ emerging closed loop networks. PayPal and Square (through its acquisition of Afterpay) are the two most obvious examples, with Square in particular being highly focused on bringing this vision of a new closed loop payments network to fruition.

The BNPL-ification of everything. Finally, we are seeing BNPL being adopted as a wedge product for fintech startups, typically focused on a specific vertical or use case that isn’t already well penetrated by the big BNPL providers. BNPL for B2B payments is the most popular example, but we have also seen BNPL for healthcare, BNPL for car repairs, and BNPL for rent, among others.2

What do customers want?

But what about customers? Are they onboard with the BNPL-ification of everything?

According to consumer survey data from Cornerstone Advisors, it appears that the answer is yes. While BNPL saw relatively modest growth between 2019 and 2020, we project that total BNPL transaction volume in the U.S. will reach nearly $100 billion in 2021, a significant increase.

Despite this growth, it’s worth noting that $100 billion still pails in comparison to the trillions of dollars of transactions facilitated by credit cards, debit cards, and cash.

More significantly, BNPL isn’t a perfect solution for customers. 31% of BNPL consumers consider their financial health to be “dire” or “struggling” (versus “managing” and “thriving”). In contrast, of consumers who don’t use BNPL services, just 20% rate their financial health as dire or struggling. Over the past two years, 43% of BNPL users made late payments and, interestingly, two-thirds of them said it was because they lost track of when the bill was due (versus not having enough money to pay the bill).

How should this impact product roadmaps?

The first challenge in BNPL was convincing consumers and merchants to adopt it. That’s now mostly done.

The next challenge is finding ways to leverage BNPL to improve consumers’ overall financial health — cash flow management, credit building, etc. — while still delivering value to merchant partners.

Anyone thinking about BNPL right now should focus on financial health.3

Green Banking

What’s happening?

Consumer demand for sustainability (and ESG more generally) is surging. This is leading companies to invest in sustainability at a few different levels:

Sustainability-as-a-Service. Carbon accounting platforms, offset marketplaces, and impact measurement services are seeing record investment (more than $100 million) in 2021.

Sustainability built into financial services infrastructure. Stripe is a leader here, with its carbon removal purchase tool for small businesses and its recently announced partnership with Deep Science Ventures, a London investment firm that will recruit scientists to develop ways to remove carbon dioxide from the atmosphere. Mastercard has also launched a carbon footprint calculator for banks to offer their customers.

Sustainability-focused financial services brands. Aspiration, ATMOS, Carbon Zero, Cushon, Trine, and Raise Green all offer sustainability-focused deposits, investment, and lending products. These companies are building brands designed to attract climate-conscious consumers across generations.

What do customers want?

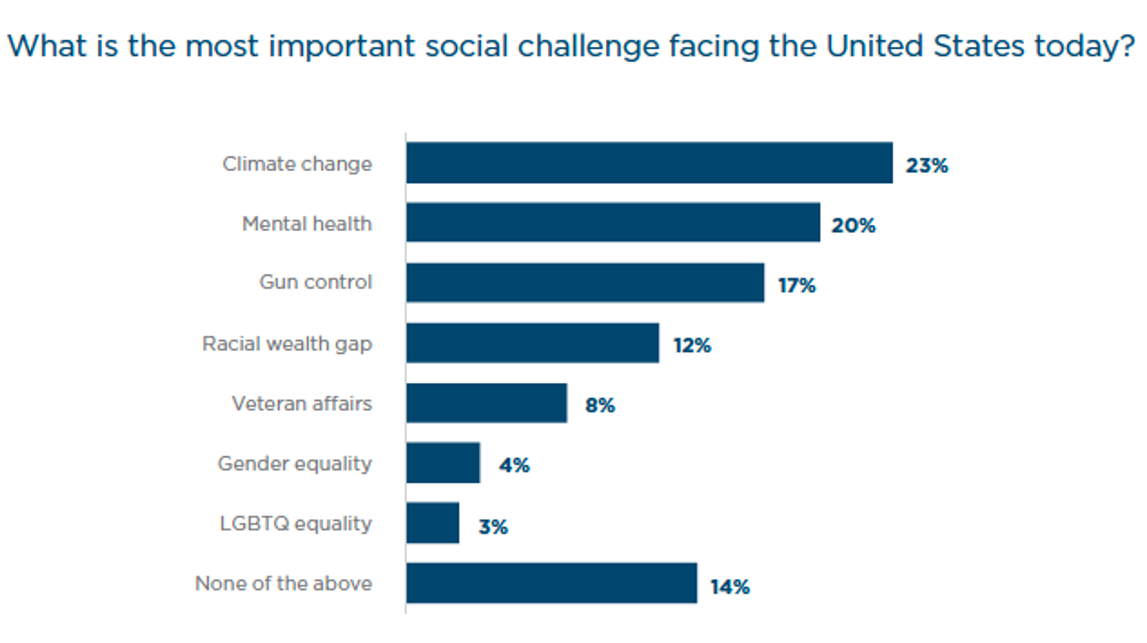

In a recent consumer survey conducted by Cornerstone Advisors, consumers were asked “what is the most important social challenge facing the United states today?”4

Climate change was the most popular response.

Not a huge surprise.

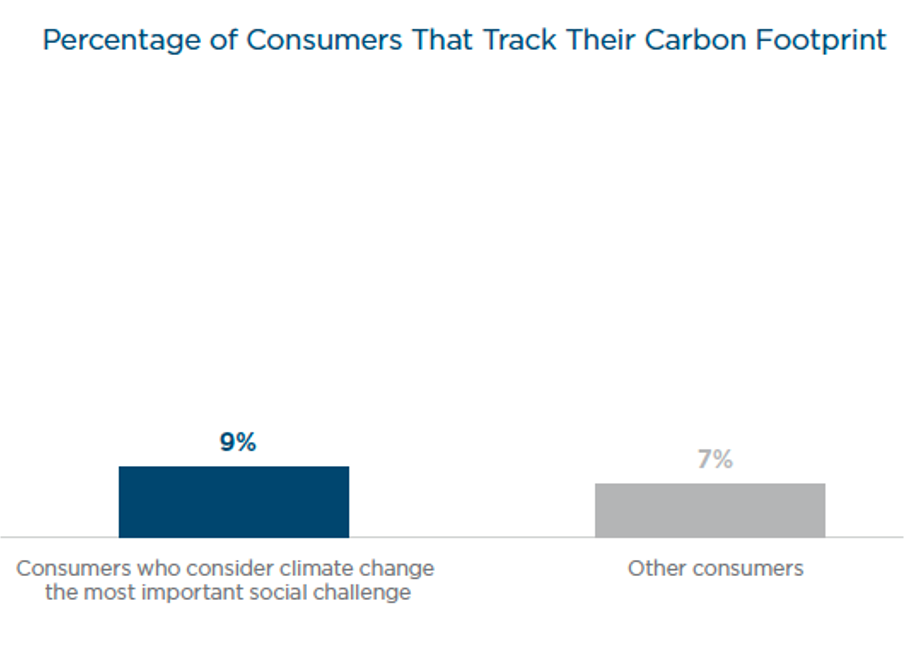

Where things got interesting is when we asked consumers what steps they take in their daily lives to actually address climate change. Do they, for instance, track their carbon footprint?

Most consumers told us that they don’t, but the really interesting part is that there was virtually no difference between the 23% of consumers who consider climate change the number one most important social challenge facing the U.S. and all other consumers.

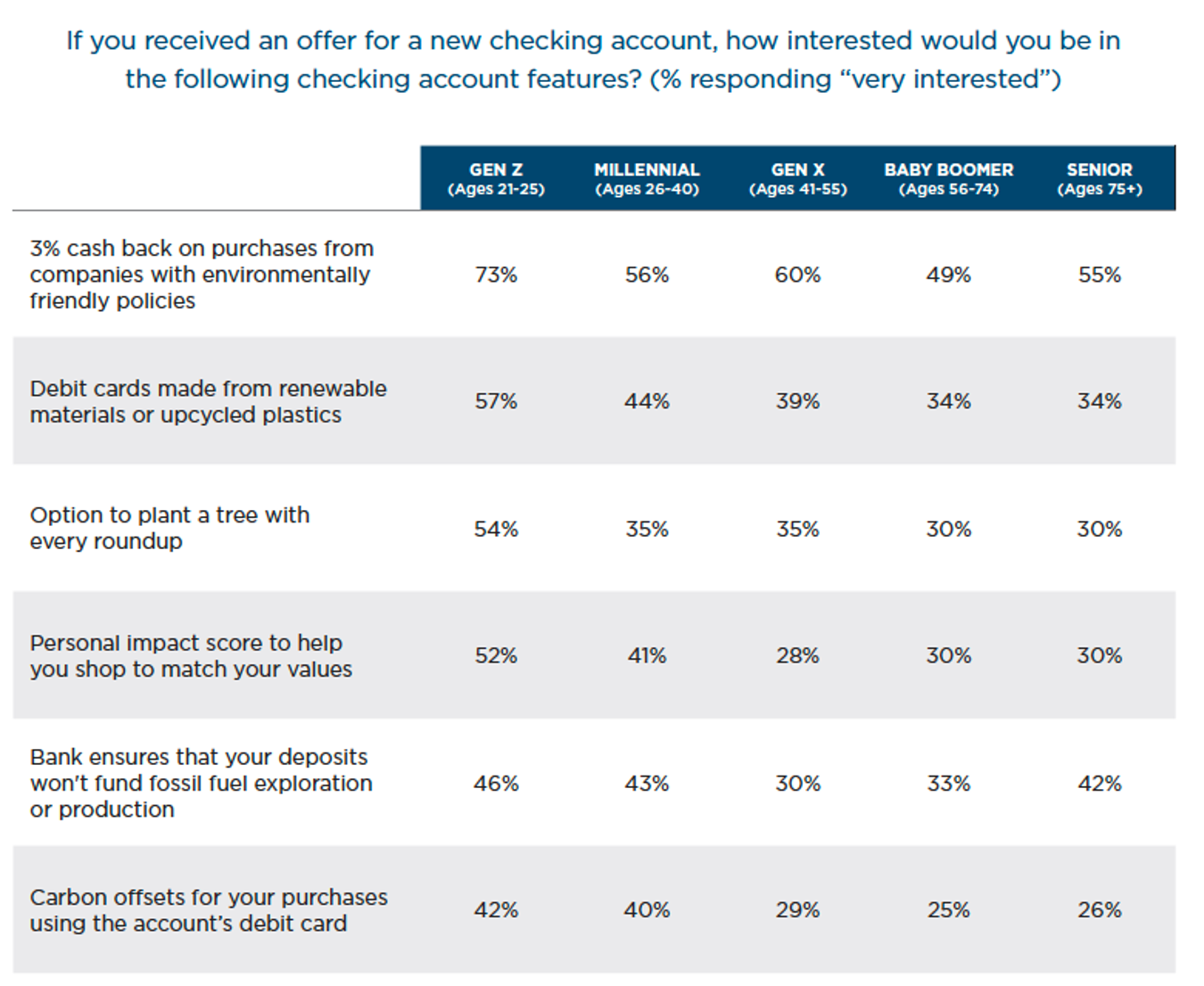

This discrepancy is the reason why demand for embedded sustainability is growing. Consumers are increasingly worried about climate change, but even the most concerned consumers struggle to translate that concern into tangible action. Consumers (particularly younger consumers) want sustainability built into the products they use on a daily basis. Checking accounts, for example.

How should this impact product roadmaps?

Sustainability as a standalone brand is a challenging long-term strategy. The rising popularity of climate-focused messaging and products (and the growing focus on ESG overall) will make it difficult for companies like Aspiration to standout from the crowd.5

Sustainability as a product feature will, however, become table stakes faster than you might expect. Consumers, especially Gen Z, are demanding more than corporate ESG policies. They want sustainability built into the products they use everyday.

Are you building a deposit, investment, or lending product? You better have a plan for how usage of your product positively impacts the environment.

Super Apps

What’s happening?

Attention has become the most valuable commodity in financial services. The rebundling of fintech is being driven by a larger fight to capture and monetize customers’ attention. This is playing out at a couple different levels within the fintech space:

Commerce-focused super apps. This is the true, Alipay-style definition of a super app — the blending of financial and non-financial activities into a single, integrated environment. This is what Dan Schulman wants PayPal to become (although the pullback from the reported Pinterest acquisition perhaps demonstrates the limits of shareholders’ tolerance for this vision). It’s also what the big BNPL providers — Affirm, Klarna, Square/Afterpay — are building towards.

Financial services marketplaces. One step down from the commerce-focused super app, is the financial services marketplace. This is the modern incarnation of the old ‘banking app store’ concept that we used to talk about — a platform that provides a combination of direct financial products and a marketplace featuring the products of other financial services providers. Two interesting examples of this model are Credit Karma, which has expanded from solely recommending other companies’ products to now offering a deposit account with an interesting approach to rewards, and MoneyLion, which claims to be building its own open marketplace.

What do customers want?

According to consumer surveys from Cornerstone Advisors, approximately 1 in 3 consumers have more than one checking account. This finding undermines the idea that consumers want a single financial super app.

However, when we asked consumers how their frequency of interactions with their primary, secondary, and tertiary checking accounts changed over the course of the pandemic, we found something interesting. Consumers indicated that they had scaled back on experimenting with multiple accounts and had settle in with their favorites.

And who were their favorite accounts with?

We saw a significant shift, between October 2020 and July 2021, in primary checking account status from traditional banks to fintech companies, with Bank of America among the biggest losers and PayPal among the biggest winners.

How should this impact product roadmaps?

The COVID-19 Pandemic and the resulting increase in the usage of digital channels accelerated the adoption curve for fintech. Consumers moved from experimenting with multiple financial services apps to focusing more on their favorites.

Neobanks and other fintech apps benefited from this shift. Apps that offered a wide breadth of functionality — PayPal, Cash App — were especially well-positioned to see increased engagement and conversion to primary account status.

There’s no evidence (yet) that consumers want a single app to rule them all (or even an open financial services marketplace), but the rebundling of fintech apps into full-service banking apps does appear to be paying dividends for some providers.

Sponsored Content

Fintech Meetup is the industry’s next can’t miss event! It’s the easiest and most efficient way to find new partners and customers! Get your ticket before prices go up on Friday, so you can meet leading banks including Bank of America, Citi, Goldman Sachs, JP Morgan, Wells Fargo, neobanks including Dave & Revolut, networks, investors, community banks, credit unions and more! Prices go up on Friday, so Get Ticket Now

Short Takes

Fintech-as-a-Service

Extend, a digital payment infrastructure platform that helps banks compete with fintechs, raised a $40 million Series B.

Short Take: This is interesting — Ramp-as-a-Service for banks. Zero integration because it’s already built on the legacy payment processing infrastructure that banks already use. Apparently the company just signed American Express as a partner, which should accelerate growth significantly.

Travel is tricky.

Selfbook, a hotel payment platform, raised a $25 million Series A.

Short take: Travel presents some weirdly hard fintech problems. Hotels, for example, tend to break payments up into all kinds of separate charges that can be tricky for consumers to manage and reconcile. Fintech companies focused on travel would seem to have a defensible moat.

How many headless checkout solutions do we really need?

Rally, a one-click headless checkout solution, raised $6 million.

Short take: This is kind of a weird quote from one of the investors in Rally?

Like, it’s great that this company fits into an established category with a lot of larger competitors, but doesn’t that also mean that it might have a tough time standing out from the crowd? How many headless checkout solutions do we really need?

Fintech Recap: Money20/20

ICYMI, Fintech Takes now offers a podcast — Fintech Recap.

In this inaugural episode, recorded at Money20/20, Jason Mikula and I break down the fintech trends that everyone was talking about at the show, including crypto, the intersection of payments, commerce, and social media, and the increasing focus on fintech infrastructure.

Give it a listen!

Alex Johnson is a Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies.

Twitter: @AlexH_Johnson

LinkedIn: Linkedin.com/in/alexhjohnson/

I wrote about this shift in this piece that touches on Klarna.

I see this verticalization of BNPL increasing, for two reasons. 1.) As fintech continues to collide with vertical-specific SaaS products, I predict that BNPL will be a popular embedded payment option. 2.) Mid-size banks have the opportunity to create mini BNPL networks between their consumer customers and their commercial clients, most of whom tend to fall in specific verticals like construction or entertainment.

Read the full research report on this subject, sponsored by Meniga. It’s fascinating.