The Gentrification of Deposits

The checking account is being condemned. Here's what's replacing it.

Where should I keep my money?

For consumers, this is perhaps the most foundational question in financial services.

It used to be fairly simple to answer. Unless you were a gold bug or a subscriber to the mattress-as-a-vault philosophy, the answer was a deposit account. These products came in several different flavors (demand, time, savings), but were all essentially the same thing — an account with a regulated financial institution that was insured by the government and that provided a set of common features to facilitate spending and wealth building.1

Today, the question is a bit trickier to answer.

Between banks, credit unions, fintech companies, and other non-bank financial services providers, consumers have never had more choices for where to keep their hard-earned cash.

That’s great … in theory.

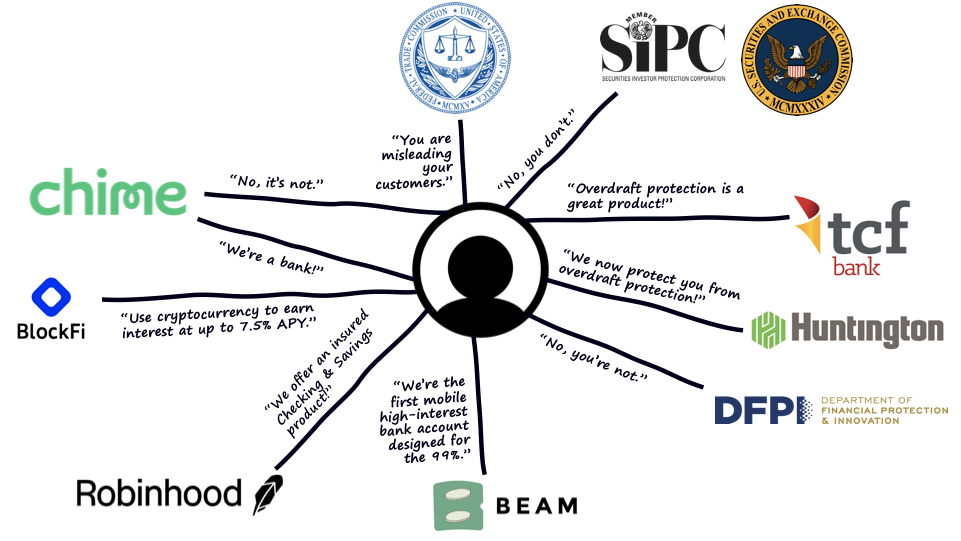

In practice, it can feel a bit like being in the middle of a crowded room with everybody shouting at you.

The hardest part of being in the middle of this fracas is that not everything is black and white.2 Technically, Chime isn’t a bank, but it does provide banking services. The ability to overdraw a checking account balance for important transactions is a legitimately valuable product feature and yet I think we can all agree that overdraft fees have become a huge problem.3 You can earn amazing interest rates through DeFi yield farming, but those activities carry risks that aren’t always made abundantly clear.

There’s risk! There’s opportunity! There’s misleading marketing! There’s paternalistic disapproval from regulators! And there’s plenty of hyperbolic press coverage!

From a consumer vantage point, it feels chaotic.

It feels that way because it is that way. The traditional deposit account has been dynamited by fintech (and DeFi) and the basic building blocks are being moved around and reassembled into new and interesting value propositions.

Put simply, we’re living in the middle of a construction zone.

And what do you do while living through construction? You find somewhere safe and cheap to sleep and keep your stuff and then you spend all your free time literally anywhere else.

That’s basically what’s been happening in financial services for the past few years.

My colleague Ron Shevlin coined the term “paycheck motels” to describe this phenomenon:

Checking accounts have become "paycheck motels"--temporary places for people's money to stay before it moves on to bigger and better places. The cause of this is deposit displacement: the displacement, or diversion, of funds from traditional accounts (i.e., checking) to alternative accounts.

And the bigger and better places that consumers’ money has been moving on to? Those are the ‘new neighborhoods’ that fintech companies and other non-bank financial services providers have been building.

Let’s take a quick tour.

The New Deposit Product Landscape

Within the realm of deposits, there are six essential jobs to be done. These jobs are the focal points for the current wave of product innovation that we are seeing in the space.

Spend — Facilitate payments; everything from paying bills, to shopping, to repaying a friend for lunch (P2P). Also includes rewards and short-term credit (overdrafts, small dollar lending, BNPL, etc.)

Save — Increase the percentage of money set aside for future needs and long-term opportunities. This isn’t about yield. It’s about the discipline of saving.

Earn — Facilitate faster access to earned income and enable opportunities to generate additional income.4

Plan — Gain insight into current financial situation and optimize day-to-day spending and saving decisions in order to maximize future opportunities. Includes everything from budgeting to building a better credit score.

Invest — Generate desired return, at acceptable risk levels, over a long time horizon. Largely dominated by robo advisors today, but also includes active investing platforms that emphasize long-term strategies.

Speculate — Generate maximum return over a short time horizon, with the expectation of significant risk and volatility.5

The products built around these jobs to be done can generally be organized across two different dimensions.

Automation - Engagement — Does the end customer want to be actively engaged in the use of the product or would they prefer for it to function automatically with little to no intervention?

Return - Predictability — How much risk is the end customer comfortable with for the specific job?

Some jobs to be done are obvious fits within particular quadrants; the whole point of financial speculation is to actively make bets on short-term, high-risk situations with the goal of generating huge return.

However, a lot of other jobs to be done can, it turns out, be done in a number of different ways.

Take savings as an example.

While savings products need to be predictable (an emergency fund doesn’t make much sense if a sudden swing in the market can wipe it out overnight), there are diverging schools of thought on how engaged a customer should be in the experience.

Digit believes the future is automated. Its wedge product was a service that connected to a customer’s checking account, analyzed their cash flow, and automatically set money aside into a linked savings account with no instruction or intervention from the customer.

Yotta, by contrast, is building a future in which savings is…fun. Its core product is a savings lottery, in which every $25 that a customer deposits in a Yotta savings account earns that customer one recurring ticket in a weekly number draw that pays out cash prizes up to $10 million.

Understanding where companies sit in this framework is important because it gives us a window into how their product offerings will evolve.

No company is content to stay within its wedge. All of them want to rebundle into full-service providers that can meet a majority of their customers’ needs. They don’t want to be the spot that customers occasionally visit when they are trying to get away from their paycheck motels. They want their customers to move in, which means getting the direct deposit.

To do this, Digit recently announced Direct — an account that automatically facilitates saving (its core product), budgeting, and paying bills. These new capabilities, along with passive investing features introduced last year, increase the number of jobs that Digit can help customers do (Save, Spend, Plan, and Invest) while keeping the company firmly anchored in the bottom-left corner of the Deposit Product Landscape Framework.

Yotta has also introduced new features designed to broaden its product’s appeal and capture the direct deposit, but with a focus on further increasing customer engagement, with features like early access to direct deposit, Pool Play (save with friends to increase lottery odds), a credit builder loan, and ‘Crypto Buckets’ that deliver DeFi yields while also earning more lottery tickets. Like Digit, these additional product features increase the number of jobs being done (Save, Spend, Plan, and Invest), but with a focus on engagement above all else.

You can play this game with any fintech company that handles consumers’ money:

Wealthfront — Started in the robo-advisor space, but has developed a compelling vision for ‘self-driving money’ that has anchored it on the automation end of the spectrum as it has added Spend and Save capabilities.

Acorns — Started in the investment space as well with its automated ‘round up’ functionality and has continued with a theme of automation as it has added Spend and Earn capabilities.

Current — Building out a classic neobank (early access to direct deposit, debit card with no overdraft, etc.), but with early roots in crypto that are starting to manifest in the form of interesting partnerships.

Chime — Similar to Current (and most other neobanks), but with a stronger focus on Plan capabilities (it was early to the credit builder product trend) and an apparent disinterest in crypto, which makes it highly unusual among its peers.

Robinhood — The ultimate example of a fintech app designed for engagement — 47% of its users use the product daily thanks largely to its addictingly fun options and crypto trading. After a dramatic false start, Robinhood successfully added spend and save functionality with its Cash Management product.

Cash App — Another contender for the crown of ‘most engaging financial app’, starting with its massive success in P2P payments and continuing with its rapid product growth in Invest and Speculate capabilities. Cash App is expected to add Plan capabilities through its acquisition of Credit Karma’s tax preparation business and will, I’m sure, continue to drive increased engagement through its investments in culture.

In all cases, the end goal is the same — to build a new and compelling ‘neighborhood’, with its own distinctive character and set of values, which their target customers will want to permanently move their money into.

TL;DR

Today’s consumers have an unprecedented number of options for where to put their money. Few of these options have been perfected…yet. However, the ongoing gentrification of the deposit product landscape has already transformed traditional checking accounts into mere paycheck motels and will, eventually, lead to a more permanent relocation of consumers’ direct deposits.

Sponsored Content

Even for experienced compliance teams, navigating the landscape of security and privacy compliance requires a huge amount of research and operational overhead. From SOC 2 to ISO 27001 to HIPAA and PIPEDA, fintech companies have been increasingly relying on external compliance firms to help streamline their end-to-end process.

Laika is the only solution that completely eliminates the friction and dependence on third parties. Their platform was built as a one-stop solution from implementation to an integrated audit experience. With Laika, you can get an audit without logging into some random portal or exporting your data to provide it manually to an auditor.

Check out how they’ve helped hundreds of businesses go from zero to compliant below:

Short Takes

(Sourced from an incredible fintech news ecosystem)

Wells Fargo Wells Fargo-ing

Wells Fargo is shutting all personal lines of credit to its consumers with no warning, which is expected to negatively impact credit scores across the board.

Short take: This is a downstream consequence of the growth restrictions placed on Wells Fargo by the Fed, but it is being done in the coarse, heavy-handed manner that has come to characterize Wells Fargo over the last decade.

Live by the sword.

Chime is in hot water for closing accounts and not returning customer money.

Short take: These account closures are being spurred by an increase in fraud from accounts opened with stimulus and unemployment checks, which was a huge source of growth that Chime (and other neobanks) aggressively pursued over the last year.

Pack it up.

Short take: Fintech, we had a good run.

Featured Research

Here are the five fintech trends from June that caught my eye.

Intrigued? Check out Fintech Fire Alarms, for more details.

Alex Johnson is a Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies.

Twitter: @AlexH_Johnson

LinkedIn: Linkedin.com/in/alexhjohnson/

For a more precise, legal definition take a look at the RESERVE REQUIREMENTS OF DEPOSITORY INSTITUTIONS (h/t: @regulatorynerd)

To be clear, some things are black and white. Robinhood straight up lied about its first deposit product being insured by SIPC and Beam Financial absolutely deceived its customers.

There’s a reason that I chose TCF Bank (since acquired by Huntington) as the example here. It got so rich of overdraft fees that its former CEO actually named his boat Overdraft. Seriously.

This is, by far, the most under-addressed job to be done in deposits. Banks and fintech companies evince an almost bizarre disinterest in helping their customers find new opportunities to generate additional income. Two trends to watch in this space are platforms that help workers optimize their opportunities across multiple gigs (like Steady) and platforms that help creators better monetize their work (like Stir).

For more on the differences between investing and speculating, check out this paper on the conceptual and empirical relationship between gambling, investing, and speculation (h/t: Marc Rubinstein).